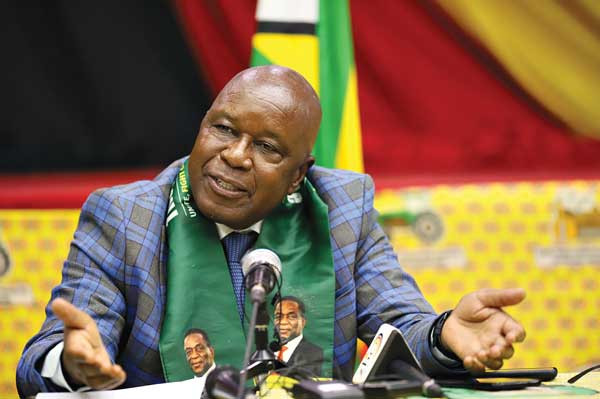

In a blistering and unfiltered critique, Khandani Msibi, Group CEO of NUMSA Investment Company and 3Sixty Global Solutions Group, has accused South African financial regulators of systematically targeting and dismantling black-owned financial institutions under the guise of regulatory oversight.

In a wide-ranging and highly charged conversation, Msibi pulled no punches, naming Reserve Bank Governor Lesetja Kganyago and the Prudential Authority (PA) as central figures in what he described as a longstanding campaign to frustrate the growth of black-owned firms in the financial services sector.

Stellenbosch University which is viewed as anti black officially appointed Kganyago as the institution's 16th Chancellor which other commentators believed he is being rewarded for sabotaging black businesses.

"Lesetja Kganyago and the Prudential Authority have destroyed black banks and insurance companies," Msibi charged. "They frustrate the licensing of black people who want to enter this industry, including myself. Actually, I should write a whole book."

He cited a string of failed or beleaguered black-owned institutions - from Nest Life and Ithala Bank to VBS Mutual Bank and 3Sixty Life - arguing that regulatory actions such as curatorship have been selectively and harshly applied. Msibi questioned why black-owned entities are swiftly sanctioned while larger, historically white-owned firms with similar solvency challenges are allowed room to recover.

Msibi's criticism follows the prolonged curatorship of 3Sixty Life, an insurer servicing primarily NUMSA members. The company was placed under curatorship in December 2021 on the grounds of liquidity and solvency concerns. However, nearly two years later, the insurer remains under the control of a court-appointed curator.

"You placed 3Sixty Life on curatorship on 21 December 2021, making certain allegations about solvency and liquidity. Ordinarily, 3Sixty Life should not have existed beyond six months if your assertions were true," Msibi said.

He further alleged that the company had successfully recapitalised, and solvency was no longer an issue. Instead, he claimed the continued curatorship is being justified by the failure to finalise audited financial statements - a failure, he says, orchestrated by the curator herself.

"She [Fagmeedah Petersen-Cook] dismissed the actuarial firm and the internal auditors. How do you finalise audits without auditors? We've been stuck in curatorship for 22 months because of unaudited statements, not because of solvency," said Msibi.

Msibi accused the SARB and PA of weaponising curatorship to stifle black economic empowerment in the financial sector, particularly during the COVID-19 crisis, when many firms - not only black-owned - faced liquidity strain.

"The idea that you place companies under curatorship to protect policyholders is disproved by the mayhem you have allowed curators to unleash," Msibi said, referencing client service disruptions at Doves Group, which is part of the broader 3Sixty Group.

He added that 3Sixty Life's entry into certain "forbidden areas" of the market may have triggered regulatory hostility. "3Sixty Life was beginning to compete in spaces where we were not welcome. That's the real issue," he argued.

Beyond regulatory concerns, Msibi suggested there may be financial motivations behind the prolonged curatorship, pointing to alleged disparities in curator compensation.

"The initial curator was paid R400,000. The current curator is being paid over R2 million. There's a gravy train here. The longer 3Sixty Life stays under curatorship, the more some people benefit," he claimed.

Msibi's comments speak to a deeper frustration with South Africa's economic transformation agenda, particularly Black Economic Empowerment (BEE), which he says has failed to deliver meaningful control over key financial assets.

"The economic liberation of black people will never happen if we don't own banks," he declared.

He also challenged the effectiveness of black regulators in promoting true empowerment, saying many have become gatekeepers rather than enablers.

While litigation between 3Sixty Life and the PA has temporarily quieted, Msibi's public statements suggest the battle is far from over. He has signaled his intent to keep speaking out - and fighting - until systemic barriers to black ownership in financial services are dismantled.

With mounting pressure on the Prudential Authority and Reserve Bank to justify the continued curatorship, the controversy is likely to reignite debate over regulatory fairness, transformation, and who truly benefits from South Africa's financial system.

- BD

MCAZ deploys tech to fight fake medicines

MCAZ deploys tech to fight fake medicines  Lesetja Kganyago has intentionally destroyed black businesses

Lesetja Kganyago has intentionally destroyed black businesses  Gates launches plan to reduce population growth in Africa

Gates launches plan to reduce population growth in Africa  ZSE pushes for another equities tax cut to boost selloffs

ZSE pushes for another equities tax cut to boost selloffs  Zimbabwe repays US$176 million in external debt

Zimbabwe repays US$176 million in external debt  Mt Darwin's multimillion dollar tourist resort takes shape

Mt Darwin's multimillion dollar tourist resort takes shape  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick