CAIRNS Holdings Limited has completed evaluating its business in preparation for a fresh capital injection by prospective investor, Vasari Global Limited.

It was not immediately clear what the value of the business is, but the investor is expected to inject between $8 and $10 million in fresh capital to return the firm to optimal capacity.

Sources said yesterday Vasari Global wanted the latest stock on the assets of the company, interim performance report and the general condition of the business before injecting funds.

"The fact that the deal has taken long to complete is normal considering that the investor is expected to bring in a lot of money into the company.

"The process has been completed. Normally investors do an evaluation of the business, after all approvals, the investor undertakes a situational analysis to see where the business is and whether the parameters are still where they were from the time of the first assessment," said a source.

Vasari Global beat other prospective suitors namely Dairibord and Judah Holdings and another South African firm Eastern Trading Company Limited for the right to acquire the Reserve Bank's 67 percent stake in the company.

Cairns was put under judicial management in November 2012 after production nosedived on the back of antiquated equipment and lack of funding. Judicial manager Mr Reggie Saruchera could not be reached for comment yesterday but sources said things were looking well at Cairns with a scheme of arrangement expected soon to endorse agreements after completion of the evaluation of the business.

"Everything has been done (including evaluation) and we are now waiting for the investor to inject funds. The investor will clear all the liabilities and in addition, he will put in fresh capital," another said yesterday.

The food manufacturing company, with a staff complement of about 659 workers, is saddled by about $20 million liabilities the investor will have to clear.

Cairns has obtained all the regulatory approvals with the scheme of arrangement the only legal process outstanding before the investment deal is finalised.

The firm returned to profitability after ramping up production capacity from a record low of about 10 percent in 2010 to well over 35 percent at the moment. This follows acquisition of new equipment by the former Zimbabwe Stock Exchange-listed firm after it accessed $1 million under the Distressed Industries and Marginalised Areas Fund to buy equipment, mainly, for snacks and canning business.

The investment proposal by Vasari Global follows the approval by the majority of shareholders and creditors of the company in June last year of the judicial manager's proposal for a scheme of arrangement that will see the investor injecting fresh capital.

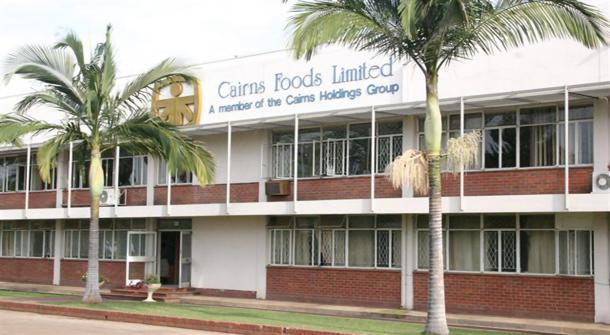

Cairns is a fast moving consumer goods manufacturer with particular interest in vegetables, snacks, chips, groceries and beverages. The brands are household name in Zimbabwe.

- The Herald

OK Zimbabwe posts US$17,8 million loss

OK Zimbabwe posts US$17,8 million loss  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  Econet Zimbabwe to delist from ZSE

Econet Zimbabwe to delist from ZSE  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Mnangagwa fires Chitando, appoints Polite Kambamura

Mnangagwa fires Chitando, appoints Polite Kambamura  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick