Brick maker Willdale Limited's rights offer has been grossly under subscribed by shareholders after only 15 percent of the owners responded to the $3,2 million cash call.

Chief executive Mr Clifford Mushambadzi recently said Willdale was targeting an immediate return to profitability after successfully raising bridging finance and restructuring.

Shareholders took up a mere 408 828 preference shares out of a total of 3, 255 million preference shares on offer while an underwriter snapped up the balance. The effective subscription rate was 14,77 percent, but the underwriter, Old Mutual, made sure that Willdale managed to raise its targeted amount of $3,255 million from the cumulative preference shares at subscription rate of $1 per share.

This was after directors issued semi-annual redeemable convertible preference shares after receiving the backing of shareholders at an annual general meeting of shareholders held last month.

The AGM approved the cash call at the ratio of one 10 percent semi-annual redeemable convertible cumulative preference shares for every 546 ordinary shares already held by shareholders of the brick maker.

Ordinary shares arising from the conversion of preference shares as per terms of the rights issue will rank pari passu with existing ordinary shares of the company.

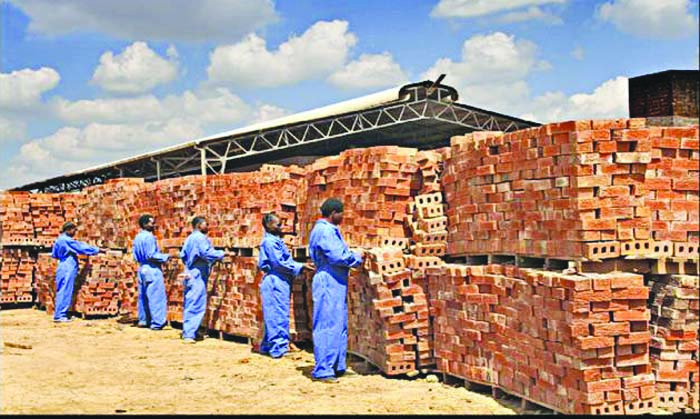

Willdale said new equipment would eliminate excessive down time caused by old equipment, which the company said had affected the viability of its operations.

Willdale directors believe fresh capital will improve production, reduce its debts and bring economies of scale.

Funding raised from the rights issue was earmarked to go towards further capital and working capital expenditure as well as retiring the bridging finance loan facility of $1,5 million secured from CBZ Bank, part of which was used secured new equipment for the firm.

Recapitalisation has allowed the company to cut on down time from an average of 56 percent in 2013 to 80 percent. Focus is now on incremental production at an average of 30 percent per month until August this year.

Management said the funds would further lower the cost of borrowing, which has already been reduced through debt restructuring for loans amounting to $3 million.

The restructuring of loans has resulted in the tenure of existing loans, a significant portion of which was an overdraft, being rescheduled from short term (two years) to medium term (five years). Further, the cost of the various loans has also been negotiated downward from an average of 11-16 percent to 10 percent per year.

Management had pointed out that failure to raise fresh capital would result in the brick making company continuing to operate at sub-optimal levels.

Willdale incurred a loss of $744 000 in the year to September 2013 and as of that date the value of current liabilities exceeded that of current assets by $4,2 million.

To give effect to the transaction, Willdale would increase its authorised ordinary share capital from two billion to three billion ordinary shares of $0,00005 each.

- The Herald

OK Zimbabwe posts US$17,8 million loss

OK Zimbabwe posts US$17,8 million loss  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  Econet Zimbabwe to delist from ZSE

Econet Zimbabwe to delist from ZSE  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Mnangagwa fires Chitando, appoints Polite Kambamura

Mnangagwa fires Chitando, appoints Polite Kambamura  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick