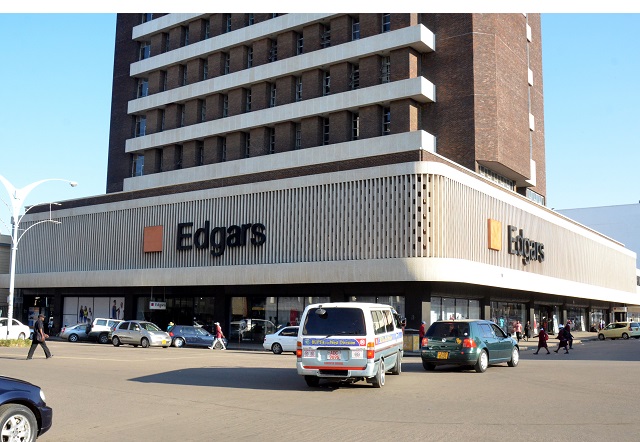

Listed clothing retailer Edgars Stores Limited's turnover for the first quarter to April 2018 grew 37 percent from the comparable prior year and was 10 percent above budget. After-tax profit was however 2,5 percent lower at $1,3 million, but management said the profit was "well above budget".

For the period under review, Edgars' unit sales rose 13,9 percent over the same period in 2017.

Group managing director Linda Masterson said the first quarter performance is pleasing given the constrained environment.

"This is pleasing in the constrained environment of foreign currency shortages and the negative impact this has on margins and merchandise assortments.

"Growth in turnover has slowed due to under-planning of winter assortments in the Jet chain and Edgars has been affected by the civil servant involvement in electoral roll verification. Despite these setbacks we are still showing real growth on the top line," said Masterson in a trading update.

Gross margins for the Edgars Chain have come down from 46 percent in 2017 to 43 percent, while Jet has maintained sales margins at 38 percent.

The MD said finance income dropped from $3 million last year to $2,3 million this year.

"This is a result of a cleaner debtors' book driven by consistent civil servants salaries, enhanced control environment from the ERP system and good efforts from our collections teams."

The retail business's operating loss has come down from $1 million last year to $0,3 million this year.

Edgars said it "continues to focus on cost control," with factory loss reducing from $208 000 last year to $25 000 in the current year.

"The factory now trades as a division of Edgars Stores Limited (from January 2018). The drive to export remains at the top of our agenda."

Club Plus, the group's new micro finance subsidiary, has grown to a loan book of $1 million at the end of April 2018. It however made a $54 000 year-to-date loss, which management attributed to "growing pains". They expect it to breakeven by June 2018.

Current debtors (net of allowance for credit losses) for the period under review stood at $21, 4 million, a 3 percent increase from last year.

The group's number of accounts as at end of April 2018 was 267 611, up from 255 080 in the prior period, with 59 percent being active. Active accounts however declined by 28 000 from last year.

Masterson said the clothing retailer's inventory grew by 30 percent over last year.

Total borrowings for the period were down to $3,7 million from $5,3 million last year. The group says $1,3 million is payable within 12 months and the balance is payable over the next three years.

Finance costs have consequently come down by 50 percent compared to last year.

"We expect our borrowings to grow to fund the growth of the micro finance business unit and Capex requirements in the retail and manufacturing divisions," said the MD.

Trade and other liabilities include foreign liabilities of $2,8 million and dividend accrual of $1 million.

Going forward, management said it maintains expectation of achieving a 14 percent and a 32 percent growth in turnover and PAT, respectively.

- the herald

OK Zimbabwe posts US$17,8 million loss

OK Zimbabwe posts US$17,8 million loss  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  Econet Zimbabwe to delist from ZSE

Econet Zimbabwe to delist from ZSE  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Mnangagwa fires Chitando, appoints Polite Kambamura

Mnangagwa fires Chitando, appoints Polite Kambamura  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick