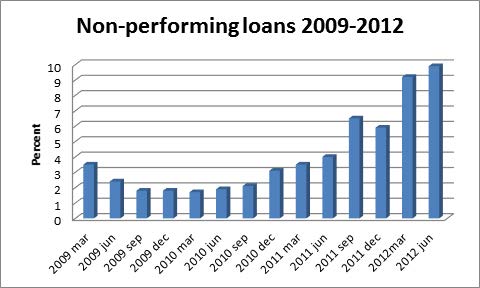

The banking sector is under pressure due a growing number of non-performing loans. This is a cause of concern in terms of the health of the banking sector. Based on figures released by IMF in 2012, non-performing loans were 9,9 percent as at June 30, 2012 as shown above.

Non - performing loans in Zimbabwe increased from 6 percent on average at end-December 2011 to 10 percent at end-June 2012.

This is higher than the prudential threshold of 5 percent stipulated in Basel II (Basel, 2004; ADF, 2012). Non-performing loans could rise further with the ongoing deceleration in economic activity (IMF, 2012). The graph shows an upward trend in non -performing loans.

The question that needs to be addressed is what has been the cause of the upward trend in non- performing loans and what can be done to reduce the level of non-performing loans for the betterment of the banking sector.

According to a study released by Interdisciplinary journal of contemporary research in business using CBZ as case study, research findings indicated that non performing loans were caused by internal and external factors.

In the context of CBZ Bank Limited, internal factors such as poor credit policy, weak credit analysis, poor credit monitoring, inadequate risk management and insider loans have a limited influence towards non performing loans.

The research findings highlighted that external factors namely natural disaster, government policy and the integrity of the borrower as the major factors that caused non performing loans in CBZ Bank Limited.

Findings indicated that there is an upward trend in non-performing loans since the adoption of multicurrency in 2009.

The upward trend has been attributed to the growth in the loan book of the bank during the period under review (2009-2012) mainly in the agricultural and manufacturing sectors of the economy.

The agricultural sector has not been performing well owing to climate changes and expensive costs related with farming in Zimbabwe.

Both sectors suffer severely from the increased competition from cheap products which are being imported from Asia and South Africa thereby threatening their viability. Findings further indicated that non performing loans have negatively affected the performance of the bank in terms of liquidity and profitability.

Another study by the Midlands state university sought to find out from banks that had problems with non-performing loans the various reasons they were sitting on those loans. Some of the reasons are presented below.

1. Unpreparedness of the economyAll the respondents cited lack of preparedness of the economy as a major contribution to non-performing loans. The background of the economy prior to the shift into the multiple currency era was characterised by lack of financing which saw most of the Zimbabwean companies operating with inadequate working capital whilst in need of capital expenditure.

The banks that were aggressive in lending appeared to have overlooked this factor and advanced loans without fully advising the clients. Most banks rushed to give borrowers funds without properly analysing clients' requirements and trading activities.

2. Lack of client knowledgeRespondents also indicated that when the economy shifted to the multiple currency systems, companies did not have financial statements.

Documentation that was supplied by the companies was in Zimbabwean dollars and in particular share capital contributed by the companies. The basis of lending was mostly historically based with bias towards listed companies.

There was lack of due diligence and proper knowledge of the client's business. This saw most banks lending to borrowers with no capacity to service and repay back their loans.

3. Ethics and corporate governance IssuesRespondents highlighted that loans at their banks were being granted based on relationships with those that required funds. Most of such borrowers would fail to honor their obligations because they would not have been properly assessed.

4. Multi-borrowing Most companies and individuals, even executives of companies accessed loans from more than one bank. Individuals were reported to moving pay points from one bank to another in-order to have access to loans clients deliberately borrowed from multiple sources with no intention of repaying loans and thrived on the information asymmetry that prevailed.

5. Weak internal systems All locally owned banks were caught unaware on the strength of their internal systems. The shift from the Zimbabwean dollar to the multiple currency systems required re-alignment of the usual systems to suit the new environment.

6. High lending rates Some respondents cited high lending rates as the reason to non-performing loans. The high lending rates contributed to most borrowers failing to service their loans.

7. Inadequate supervision by the Central Bank From the survey, all respondents pointed to inadequate supervision by the Reserve Bank of Zimbabwe which led to gross violation of prudential guidelines.

Both studies came up with the following recommendations to policy makers and to the banks themselves on how they can address the situation

• Upgrade ICT to be able to implement models that will mitigate risks

• A credit bureau to facilitate the dissemination of credit information.

• Credit analysts to be trained in credit intelligence

• Commercial banks need to come up with workout strategies clearly defining how different types of loans at different stages are dealt to be dealt with.

• Supervisors should come up with devices that would enforce commercial banks to adhere to prudential guidelines.

• In cases of importers, commercial banks should ensure that documents are in place before making payments through swift. Clients have tendencies to misrepresent and then divert the funds to other uses.

• Conventional banks may adopt the buy and sale mechanism from Islamic banking where the bank purchases goods and services on behalf of the clients and sell the goods and services to them. Conventional banking believes in funding directly which is difficult to look after.

• Impact of environmental factors such as natural disasters and government policy should be considered seriously during the credit assessment process.

• Banks to slow down on issuing loans to companies sectors that are currently not performing well.

• Loans in these sectors should only be granted if the borrower proves that they have the capacity to pay back loans given.

• Management needs to ensure that borrowed funds are being used for the intended purpose through enhanced credit monitoring.

This can be achieved by adopting a relationship management approach which helps management to have a closer look at the business as well as the characters of the senior managers running the organization.

- herald

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick