Business Reporter

Mwana Africa Plc has raised $2,8 million through a subscription and placing of shares, taken up by existing and new shareholders, to accelerate development of its mining projects.

The latest capital raising initiative comes hot on the heels of an earlier one to raise $3,2 million that was announced on September 5.

While Mwana would not name the projects set to benefit from the fresh capital, the firm requires significant funding to develop its gold and nickel projects in Zimbabwe and the Democratic Republic of Congo.

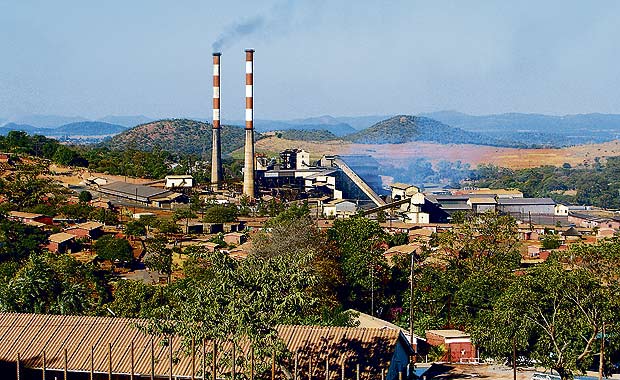

In Zimbabwe, Mwana Africa holds controlling interests in Zimbabwe Stock Exchange-listed Bindura Nickel Corporation and Freda Rebecca Mine. It is also developing a nickel project in Kwekwe.

"Mwana is pleased to announce that it has raised a further $2,8 million through a subscription and placing of 112 580 059 ordinary shares by a combination of new investors and existing shareholders of the company at a price of 1,57 pence," Mwana said.

China International Mining Group Corporation subscribed for 11 728 543 of the transaction shares while Mr Ning Yat Hoi subscribed for 21 271 457 shares.

Mr Ning is a non-executive director of Mwana. The balance of 79 580 059 shares were acquired by existing shareholders and newly issued investors.

"Following our success earlier in September in raising an initial amount of $3,2 million, I am delighted with the support shown for Mwana's strategy.

"With working capital shortfall addressed, focus can now shift to improving efficiency and cost competitiveness of the company's operations," Mwana non-executive chairman Mark Wellesley-Wood said.

The transaction price of 1,57 pence per ordinary share is the same price as that of the subscription announced on September 5 and represents a 4,85 percent discount to Mwana Africa's closing mid-market share price as at close of business on September 16.

CIMGC subscribed for 11 728 543 transaction shares and is a substantial shareholder in the company, as defined by the Alternative Investment Market Rules for companies.

The Chinese firm is therefore deemed to be a related party of the company for the purposes of the AIM rules. Mr Ning, following his rights, has subscribed for 21 271 457 transaction shares.

Following the transaction, CIMGC will hold a total of 299 424 282 ordinary shares and Mr Ning will hold 106 709 262 Mwana Africa ordinary shares, representing 22 percent and 7,8 percent of the company's enlarged issued ordinary share capital, respectively.

Following the Transaction, Mr Ning will thus be interested in 406 133 544 ordinary shares in the company which will represent 29,87 percent of Mwana Africa's total voting rights after the transaction.

Admission of the shares will commence on September 20. The shares, which comprise 109 913 459 new ordinary shares to be allotted and 2 666 600 existing ordinary shares being acquired out of treasury, are being placed pursuant to the company's existing authorisation levels as approved by shareholders at its annual general meeting held last year.

The total issued share capital of the company with voting rights on admission will be 1 359 895 227 ordinary shares and none held in treasury.

- herald

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick