ZIMBABWE'S economy may grow by 4 percent this year, lower than the Government's forecast. But the forthcoming national elections could lay the ground for a robust growth after the elections, a local research firm has said.

The national elections are expected to be held in July this year, ending a four-year coalition Government formed by the three main political parties in 2009.

"We expect growth is likely to slow down ahead of the forthcoming national elections," says Invictus Securities in its 2013 Zimbabwe Equity Strategy Outlook Report.

"We firmly believe that the forthcoming elections, expected to take place in July 2013, will be the catalyst for a more robust growth in 2014. We expect the real GDP of circa of 9,5 percent in 2014 and 9,4 percent in 2015."

Since the formation of the inclusive Government and the adoption of the multi-currency regime, Zimbabwe has enjoyed strong economic growth although the robust recovery achieved between 2009 and 2011 slowed down last year.

Government initially projected that the economy would expand by 9,4 percent last year but these were revised downwards to 5,6 percent and then to 4,4 percent.

This year, the Government estimated the real gross domestic product would grow by 5 percent and 6,5 percent next year, driven largely by the mining sector.

But Invictus noted that constraints on power supply, coupled with weak competitiveness, may pose a challenge in achieving the growth projections.

The report said the next Government should adopt a vigorous programme of structural reform and strengthened macroeconomic management which would allow the country to sustain higher rates of growth.

This would see an acceleration in revenue collection especially from the mineral sector, combined with greater fiscal prudence, which will be critical in maintaining fiscal sustainability.

It was imperative that Government sought to rebalance the expenditure mix, especially by containing the growth of the wage bill, to create the fiscal space needed for increased social spending and public investment.

Improving public financial management would help reinforce expenditure control, the report noted.

While the trade deficit had deteriorated, exports - especially in the mineral sector - would expand, as imports declined, thereby narrowing the trade deficit. The financial sector remains fragile, but the changes to the financial regulatory framework, especially the increase in capital thresholds from US$12,5 million to US$100 million, would go a long way in restoring confidence.

"As stated in the Mid-Term Plan, we expect Government to maintain the multi-currency regime through to 2015 and believe that it will be desirable for the Government to establish a currency board to review all available options," said the report.

In addressing the Government's debt overhang at US$12,5 billion or 109 percent of GDP, the research firm suggested that refraining from further non-concessional borrowing and avoiding selective debt servicing was advisable as these may complicate agreement with creditors on a debt resolution strategy.

- TC

Zimbabwe launches new airline

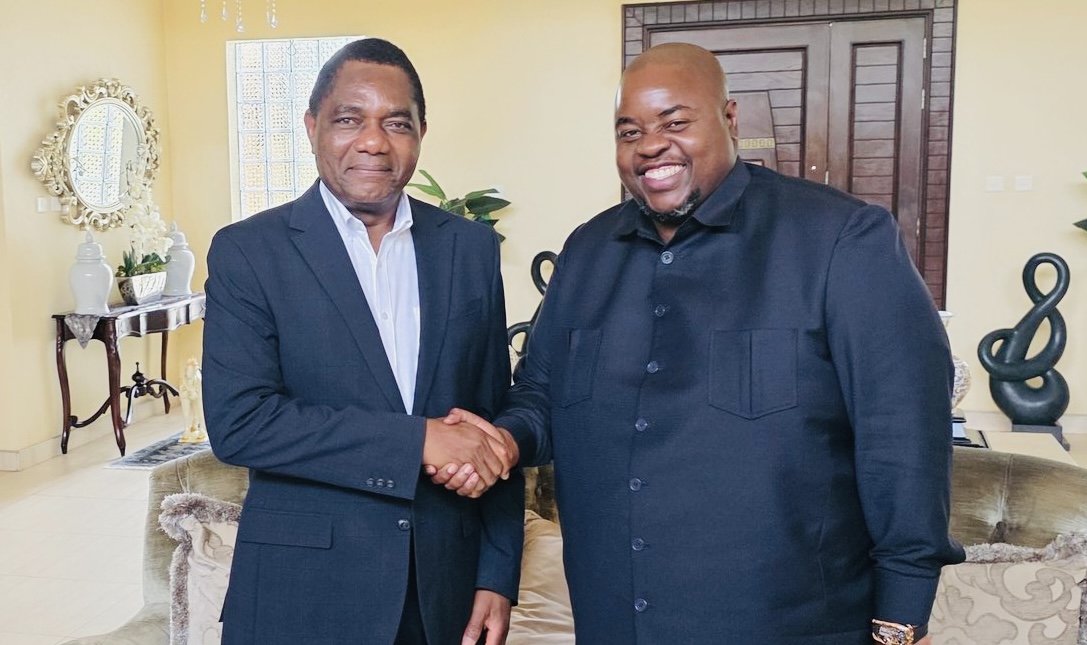

Zimbabwe launches new airline  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  SA bitcoin firm mulls Zimbabwe listing

SA bitcoin firm mulls Zimbabwe listing  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Airlink applies for Lanseria to Harare, Bulawayo route

Airlink applies for Lanseria to Harare, Bulawayo route  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick