A SENIOR Barclays Africa executive is set to jet into the country next week to meet with Indigenisation minister Saviour Kasukuwere to chart the course on how the financial conglomerate's local operation - Barclays Zimbabwe - can meet indigenisation requirements as the minister ratchets up pressure on foreign-owned banks to comply by June.

According to sources, Barclays Africa chief executive and head of Africa Group Strategy Kennedy Bungane has a scheduled meeting with Kasukuwere on Tuesday to iron out indigenisation compliance issues.

This comes after Kasukuwere wrote a letter to the Reserve Bank governor Gideon Gono on March 8 2013, insisting indigenisation of banks was well underway.

The minister warned Gono banks were not exempt from Indigenisation, a demand to which Gono said he would not succumb. The letter was copied to the chief secretary to the President and Cabinet Misheck Sibanda, his deputy retired Colonel Christian Katsande and Central Intelligence Organisation director-general Happyton Bonyongwe.

In the letter, Kasukuwere says General Notice 280 of 2012 in terms of Section 5(4) of the Indigenisation and Empowerment Act prescribed the indigenisation framework for the financial services sector.

"The General Notice requires all financial institutions to comply with the 51% indigenous shareholding requirement within a period of one year from the date of publication of the notice," reads the letter.

Kasukuwere said he was proceeding accordingly to enforce the statutory requirement.

"As a regulatory authority for the financial services sector, you will be consulted, consistent with the laws of the country, at the appropriate time," the letter by Kasukuwere to Gono stated.

Kasukuwere this week confirmed the meeting with the Barclays Africa boss.

According to documents seen by businessdigest, Barclays, which has a localised shareholding of 32,23%, wants to give a stake to an employee share ownership scheme, a pension fund scheme as well as empowerment credits.

The other foreign-owned banks, Standard Chartered, Stanbic and MBCA have almost similar plans. Gono insists Kasukuwere must stay away from banks. Barclays has also proposed to raise funding for the agricultural sector of up to US$100 million.

The National Indigenisation and Economic Empowerment Board is currently in talks with the banks to craft the best way of implementing the plans.

Kasukuwere said this week indigenisation was not just a policy, but the law, which means all the companies which fall within the brackets must comply.

"If there is in any foreign-owned company which does not want to follow the law then we will consider them as having taken a political position," he said.

Kasukuwere said overall, banks should play an important role in economic recovery.

Kasukuwere and Gono remain at war over the indigenisation of the banking sector. Gono's position is that the planned sale of the 51% stakes in the financial services sector is illegal because there is no law that provides for arbitrary expropriation of banking assets in Zimbabwe.

He also says indigenisation statutes clash with banking laws. But Kasukuwere insists that there is a provision in the indigenisation law, which says that the ministry has jurisdiction over the compliance of all business interests in the country.

Barclays Zimbabwe CEO George Guvamatanga could not be reached for comment.

- theindependent

Zimbabwe launches new airline

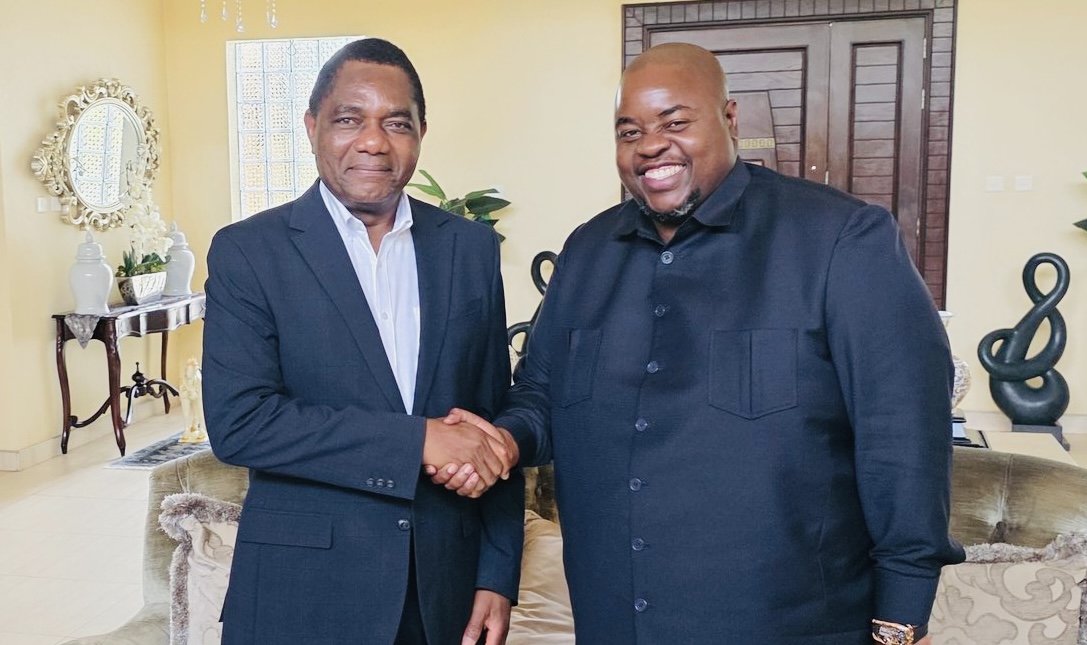

Zimbabwe launches new airline  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  SA bitcoin firm mulls Zimbabwe listing

SA bitcoin firm mulls Zimbabwe listing  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Airlink applies for Lanseria to Harare, Bulawayo route

Airlink applies for Lanseria to Harare, Bulawayo route  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick