Latest News

Top Story

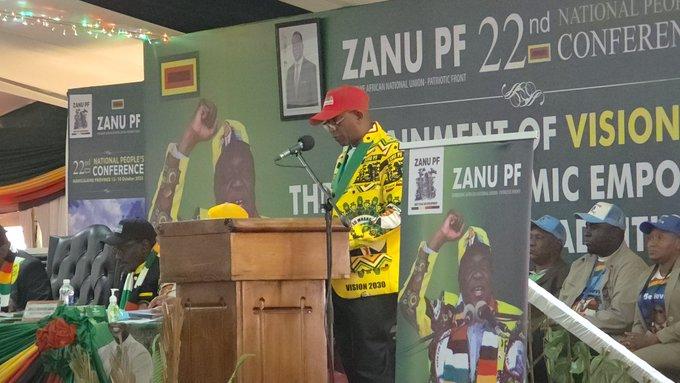

Parliament apologises to Mnangagwa

Parliament apologises to Mnangagwa The Parliament of Zimbabwe has issued a formal statement regarding the loss of power during President Emmerson Mnangagwa...

Top Story

SA decry 'non-existent' Beitbridge border post security

SA decry 'non-existent' Beitbridge border post security In a stark assessment, the South African Joint Standing Committee on Defence (JSCOD) and the Portfolio Committee on Def...

Top Story

Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India MILLIONS of Indians are celebrating Diwali, the festival of lights, one of Hinduism's most significant and widely obser...

Top Story

Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45% Zimbabwe's dollar-only stock market is riding a wave of gains, powered by gold miners cashing in on a 48% jump in the p...

Top Story

Gold edges up as traders await guidance

Gold edges up as traders await guidance Gold edged higher as traders weighed the outlook for US monetary policy ahead of a key speech by Federal Reserve Chair J...

Top Story

Karo Platinum Project capex rises to US$546m

Karo Platinum Project capex rises to US$546m The Karo Platinum Project's capital expenditure (capex) has increased by 6.45% to US$546 million, driven by higher cost...

Top Story

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019 Company Name Investec Asset Management Company Location Cape Town, Western Cape, South Africa Click HEREJob descriptionO...

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick