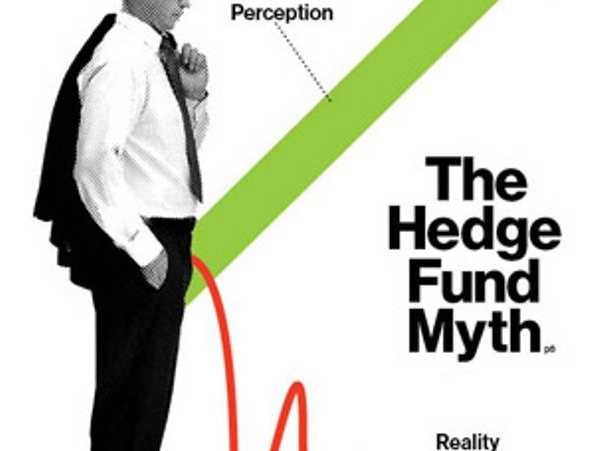

Media stories about high profile jet-setting hedge fund managers in the UK, US and Russia have given this investment instrument a bad rap. In truth, if managed correctly, a hedge fund is an effective and hardworking investment instrument that adds greatly to the diversity of a portfolio.

Grant Hogan, research analyst at Blue Ink Investments says, "Like unit trusts, hedge funds offer exposure to all asset classes, but because they are less regulated, they allow managers the freedom to short stocks and use derivatives to exploit investment opportunities. And because of the freedom hedge funds enjoy, they can be used to invest in a wider range of instruments than traditional investments."

He said choosing the right fund is critical. To help you do that, here are Hogan's top 10 tips for choosing a hedge fund:

1. Consider your motivations for investing

Many people think investing in hedge funds is about performance. However, hedge funds are most valuable for the diversification they bring to a portfolio. If you are in it solely for performance, you may be disappointed. Be clear about what you expect from the investment at the outset.

2. There are no shortcuts in selecting a hedge fund

Take your time when selecting one. There are over 100 hedge funds in SA today, and most claim to have a unique edge over the rest. They all have different strategies and sub-strategies, and have very different risk and return profiles that profit during varying market conditions.

3. Make sure the hedge fund has significant investments from fund managers

The common denominator for all good hedge funds is co-investment in the underlying hedge fund by the management team. This is one of the core tenets of hedge fund selection – that the investor's success is strongly aligned with that of the hedge fund manager.

4. Know the manager

Ensure that the hedge fund managers are experienced fund managers who have a proven ability to deliver consistent returns in many different environments.

5. Understand the investment objective

Don't invest in a fund that you don't understand. Ask for a detailed explanation of the fund strategy and what type of assets it invests in. Funds with higher rates of return may take risks that are beyond your comfort level and are inconsistent with your investment goals.

6. How liquid is the fund?

Consider your long- and short-term financial goals and the liquidity you need to match these. Most hedge funds have notice periods, and you may not be able to get your money out as quickly as you had hoped.

7. Understand the risks

Think about the amount of volatility you are comfortable with. Most hedge funds are risk-mitigating investment strategies, as opposed to return-seeking investment strategies, but there are exceptions.

8. Consider the age of the fund

You can obtain a better picture of a fund's performance by looking at how it has performed over longer periods and how it has weathered the ups and downs of the market.

9. Consider the size of the fund

Some hedge funds invest in a small number of stocks – a few successful stocks can have a significant impact on the fund's performance. But as these funds grow larger and increase the number of stocks they own, each stock has less impact on the fund's performance. This may make it more difficult to sustain and repeat past results.

10. What does the fund cost?

Understand what your fees are paying for. Is the level of fees consistent with an acceptable probability of success for the investor?

- Sanlam Investment Management

Concern over Masvingo black market

Concern over Masvingo black market  Kenya declares three days of mourning for Mugabe

Kenya declares three days of mourning for Mugabe  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Zimbabwe abandons debt relief initiative

Zimbabwe abandons debt relief initiative  European Investment Bank warms up to Zimbabwe

European Investment Bank warms up to Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick