THE Zanu-PF's Look East policy to revive the country's sagging economy has hit a brick-wall as Asian investors are shunning Zimbabwe perceiving it as a risky business destination, it has been learned.

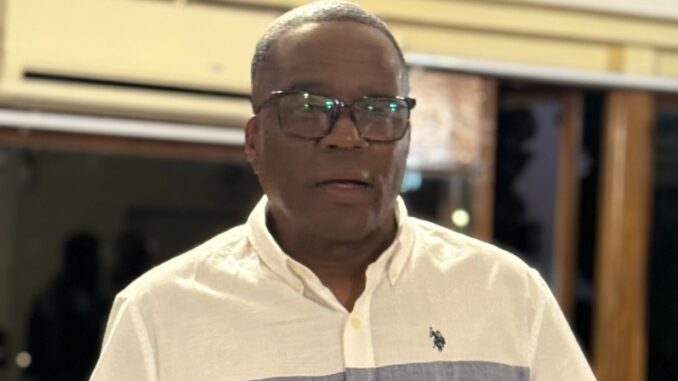

Industry and Commerce minister Mike Bimha yesterday conceded that Asian investors, including Zanu-PF's much touted all-weather friend China, were withholding their money from the country.

He was speaking during a discussion of a paper titled Delivering Sustainable Growth in Africa presented by Japan Institute of Developing Economies's Takahiro Fukunishi during a public lecture in Harare.

The investors cited political risk as the major drawback for doing business in Zimbabwe.

"There is an issue of country risk," Bimha said.

"Insurance companies cover trade risk, but don't have the capacity to cover political risk. This has a bearing not only on trade, but investment as well. Countries in the East which included Japan, China and India insist on cover against political risk."

Although Bimha said that the government was not "sitting on its laurels" in trying to woo investors from the East, it emerged that "country risk" was compounded by the fact that Zimbabwe had a seemingly insurmountable debt of around $11 billion.

Recently, Zimbabwe, which is on an International Monetary Fund staff-monitored programme, was told to first pay its debt before it could access new money from the Bretton Woods institutions – the IMF and the World Bank.

The government turned to the East for investment and trade after a fall-out with the European Union and the United States following the launch of the land reform programme in 2000.

But yesterday participants confirmed that it was difficult to do business with their counterparts from the East including Japan who insisted on insurance cover for political risk.

Zimbabwe could benefit from being a Comesa member to enjoy benefits that include trade insurance, but the country has so far failed to pay the $25 million required for it to enjoy such benefits.

"As a member of the Common Market for East and Southern Africa we have the African Trade Insurance which ironically was mooted in Zimbabwe, but now is headquartered in Nairobi, Kenya," he said. "We have started the process of being part of the initiative. Actually, we were admitted last year, but we have not paid the money we are required to pay to enjoy benefits of being a member," Bimha said.

The government, Bimha said, needed about $25 million as insurance cover.

Zimbabwe had hoped the discovery of the Marange Diamond Fields would lift the country out of its economic abyss, but this has not been the case as it is reported that very little is finding its way into the fiscus.

"I am talking to the Minister of Finance (Patrick Chinamasa) and talking to the private sector and I think the Bankers Association of Zimbabwe must join because it also affects lines of credit, to mobilise resources to pay the money required for the African Trade Insurance," Bimha said.

Earlier, Fukunishi said although Africa was experiencing a steady rise in its economic growth this was "unstable" in some instances as it was driven by natural resource.

"It could be affected by commodity price fluctuations," he said. "There is a problem of limited resource endowment per capita, for example, in the case of oil Nigeria has a per capita income of $488 while it is $15 841 for Gulf countries. There is also a problem of what we call in economics the ‘resource curse'."

Resource curse is a term which refers to a paradoxical situation in which countries with an abundance of non-renewable resources experience stagnant growth or even economic contraction.

Fukunishi said African countries should also be careful about Foreign Direct Investment without putting systems in place to benefit from the FDI spillover which refers to benefits such as technology transfer, technical assistance and access to markets.

- newsday

Top Zimbabwe business executive arrested for fraud

Top Zimbabwe business executive arrested for fraud  South Africa is in serious trouble

South Africa is in serious trouble  US halts visa services for Zimbabwean nationals

US halts visa services for Zimbabwean nationals  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe Agricultural Show 2025 kicks off

Zimbabwe Agricultural Show 2025 kicks off  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick