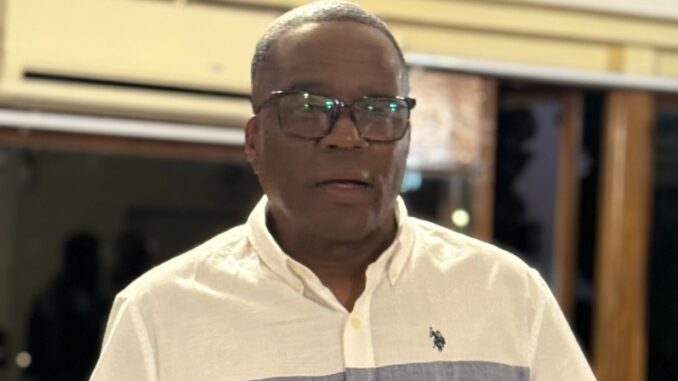

Welcome Mavingire, managing

consultant at INTELLEGO Investment Consultants, has hailed the Zimbabwe

Gold (ZiG) currency's recent stability as the longest sustained period

for a domestic currency in the country's recent history. Speaking at the

11th annual convention of the Actuarial Society of Zimbabwe in Nyanga,

Mavingire emphasized the significance of this stability amid Zimbabwe's

ongoing economic struggles.

The ZiG currency was introduced on

April 5, 2024, following the government's decision to abandon the

Zimbabwe dollar in its sixth attempt over more than a decade to

establish a stable local currency. From its debut until September 27,

the ZiG remained relatively stable before a notable devaluation from

US$1:ZiG13.99 to US$1:ZiG24.39. Authorities explained the move as

necessary to allow "greater exchange rate flexibility in line with

increased demand for foreign currency in the economy." Since then, the

ZiG has experienced minor fluctuations, currently trading at about

US$1:ZiG26.83 on the official market.

Despite this, a significant

discrepancy exists on the parallel market, where the US dollar trades

at approximately 1:ZiG36, leading to suspicions that the official

exchange rate is managed—a claim the Reserve Bank has denied.

Mavingire

noted, "We have seen a lot of stability, especially in the economic

variables, and most of that is driven by our local currency stability.

The Zimbabwe Gold has been very stable since the beginning of the year.

In recent times, this is probably the longest stretch where we have been

getting stability in our local currency."

However, he warned

that the economy remains vulnerable to shocks, including sudden

inflation spikes, often driven by psychological factors. "Everyone, even

with this stability, fears that at any moment it might collapse,"

Mavingire explained.

He also highlighted the challenges posed by

Zimbabwe's highly informal economy, where many transactions occur

outside the official banking system, making it difficult to track or

regulate economic activity effectively.

On the growth outlook,

Mavingire projected a 6% expansion for Zimbabwe this year, driven

primarily by a resurgence in agriculture and increased mining output.

"This year's growth estimate is more tangible, especially since the

government has secured agreement on this figure with international

institutions such as the IMF, World Bank, and African Development Bank,"

he said. "The major drivers are coming off a low base, as last year

experienced very slow growth."

Mavingire cautioned, however, that

tight monetary policies have led to a liquidity crunch, which could

accelerate the re-dollarisation trend. He observed that while some

companies benefit from currency volatility, sustained stability has

contributed to corporate failures over the past six months. This has

been compounded by easier access to corporate rescue mechanisms.

"The

impact on the markets has been subdued, with the stock market showing

signs of weakness but also some recent strength," Mavingire concluded.

The

Zimbabwe Gold currency's unprecedented period of stability offers hope

for economic recovery, but the path ahead remains fraught with

challenges requiring careful management and vigilance.

- newsday

Sanganai Expo preparation descends into chaos

Sanganai Expo preparation descends into chaos  South Africa is in serious trouble

South Africa is in serious trouble  US halts visa services for Zimbabwean nationals

US halts visa services for Zimbabwean nationals  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe Agricultural Show 2025 kicks off

Zimbabwe Agricultural Show 2025 kicks off  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick