Asa Resources Group PLC shares were last Friday suspended from the London Stock Exchange after the company was forced to delay implementing measures to address its dire cash-flow position because it entered into an offer period following a takeover offer from Chinese industrialist Feng Hailiang's Rich Pro Investments Ltd.

Asa controls Freda Rebecca Gold Mine and Zimbabwe Stock Exchange-listed Bindura Nickel Corporation. It said in May that cash within the business was constrained by currency restrictions imposed by the Reserve Bank of Zimbabwe.

An investigation previously conducted by the firm found that significant funds had been remitted from operating subsidiaries in Zimbabwe and not properly accounted for.

That means insufficient cash has been flowing from its subsidiaries, leaving it short of covering its ongoing liabilities.

"The company has outstanding creditors relating to legacy litigation, normal corporate expenses, consultant's fees and unpaid directors' fees and salaries. The board has been pursuing a number of refinancing options, but has not been able to finalise anything as yet and Asa's cash flow remains a serious concern," said Asa.

A former director, Yat Hoi Ning, also owns the company's offices in Hong Kong and since leaving, has made it hard for Asa to access the records and accounts of the business contained within it.

Similarly, the directors do not have control of bank accounts in Hong Kong for the group's entities that appear to remain under the control of two former directors.

Mr Ning had been Asa's chairman before moving to the role of chief executive last September.

However, he did not last long in that role as Asa removed him as well as the finance director at the time Yim Kwan following evidence emerging that the pair moved "several million US dollars" from the holding company of the Freda Rebecca Gold Mine to entities in China.

In a further twist on Friday, Asa released a statement that said non-executive Ching Fung Hung had been kicked off the board with immediate effect following "his failure to respond to repeated attempts by the board of Asa to contact him."

No other details were provided concerning Hung, but notably Asa still lists Ning as an executive director of the business and Kwan as its finance director.

"Measures that were put in motion by the board to address Asa's cash flow problem have been delayed as a result of Asa entering into an offer period under the takeover code," said Asa.

Chinese industrialist Feng Hailiang's Rich Pro Investments made a 2,1 pence per share offer for Asa earlier this month, valuing the London-listed firm at GBP35,5 million.

Asa shares last traded at 1,92 pence per share before the suspension on Friday, valuing the business at around 32,3 million British pounds.

Rich Pro's offer represented a premium of 65 percent to the company's closing price the day before the offer was made, providing a "compelling exit opportunity," Asa said at the time.

"In the light of the above, the board has been advised that it must have regard to the interests of the creditors of the company and its subsidiaries when making decisions in relation to the group," said Asa.

- Alliance News.

Zimbabwe launches new airline

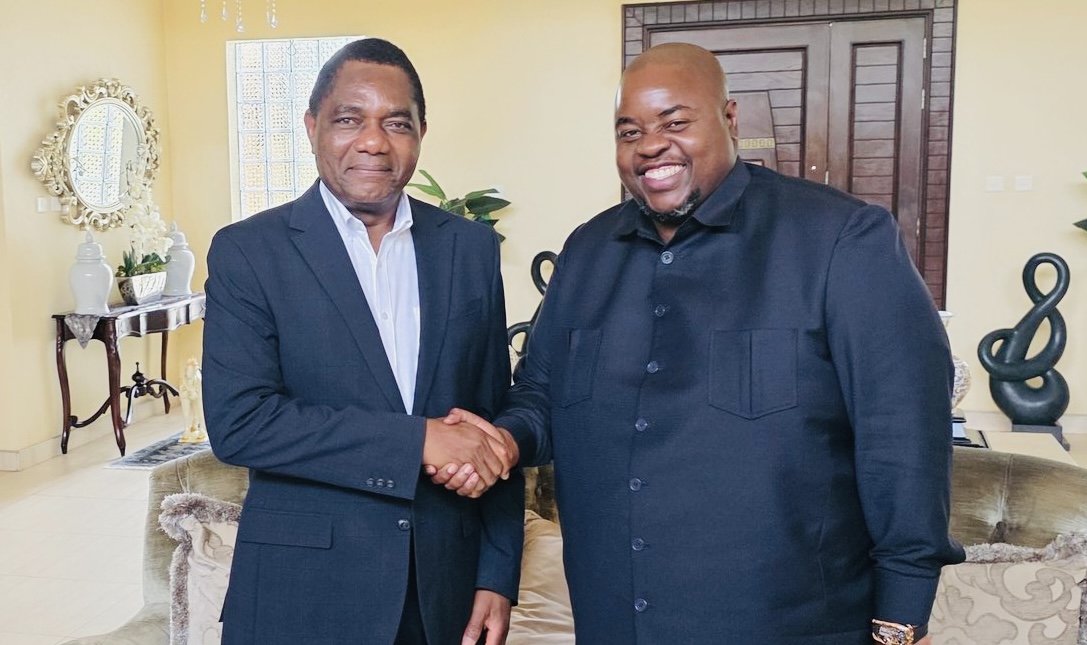

Zimbabwe launches new airline  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  SA bitcoin firm mulls Zimbabwe listing

SA bitcoin firm mulls Zimbabwe listing  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Airlink applies for Lanseria to Harare, Bulawayo route

Airlink applies for Lanseria to Harare, Bulawayo route  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick