Financial institutions are a major source of funding that individual and organisations can borrow to finance personal and business issues.

However, all borrowings from whatever source; banks, credit stores, and micro-finance institutions should be repaid by the borrower to enable the institution to continue offering credit to others.

The ability of borrowers to repay their loans ensures that they have a good track record and credit history.

It is very important that the borrowers manage their loan payments carefully since failure to repay as agreed can have serious consequences on their financial well-being.

Lending is a major line of business for many banks as they provide credit for a wide array of purposes.

The process of lending represents a key source of funds for the business sector while being an important line of business for the banking industry. The process of credit should not be disrupted by defaulting borrowers.

It is important that borrowers understand that lenders only process loans when they think the borrower has capacity to repay them.

Your credit history is important in helping you qualify, since it shows how you have used loans in the past.

Good credit means you are more likely to get a loan at a reasonable rate. Failure to repay a loan can destroy your credit rating, making it difficult or impossible to get loans in the future.

Universally, the credit providers are now facing a big challenge of non-repayment of loans by borrowers.

These credit providers include banks, credit retail shops, telecommunication companies, service providers and others involved in providing credit.

The challenge of non-payment of credit is hence derailing economic progress as the good candidates for credit are being denied loans since financial institutions are no longer sure of their creditworthiness.

With the Central Bank reporting that non-performing loans in the banking sector now stand at over 16 percent, this means that for every $100 advanced by banks, $16 is not being repaid.

This means the propensity to repay in Zimbabwe is low as compared to other countries with NPLs of around 2 percent.

Failure to repay a bank loan has serious implication on the whole economy. The potential credit cycle by the banking system is seriously reduced and creditworthy clients end up being deprived of credit.

Resultantly, the problem of non-performing loans drags on the economy in the following ways:

(i) disintermediation of bank-system lending caused by the erosion of banks' profitability

(ii) stagnation of economic resources, such as labour and capital, in fields with low productivity and

(iii) cautious behaviour of corporations and consumers due to a decline in confidence in the financial system and;

(iv) an increase in the cost of borrowing for everybody else.

Consequences of failing to repay

If you do not make payment after a period of time you are considered to be in default. Default has severe and long-lasting consequences, including the following:

The bank can immediately demand repayment of the total amount due on the loan.

The bank will attempt to collect the debt and may charge you for the costs of collecting.

The default will be reported to national credit bureaus. Your credit rating will be damaged, which will make it difficult for you to make purchases such as a car or house.

You may be taken to court where you will be forced to pay

As you undergo court processes you tend to incur high costs and unnecessary inconveniences

Your salaries or wages may be garnished to recover your owing to the lenders

Defaulting on loan obligations may result in you not being able, or being less able, to borrow again in the future from banks and other credit institutions

Credit Reference Bureau as a potential solution to loan defaults

One of the solutions that are being used to resolve the defaults in other countries is the Credit reference system. In Zimbabwe, the process of creating a Credit Reference Bureau is currently underway with the Government in close collaboration with the Central Bank working on the legal framework for establishing the Bureaus.

The establishment of the bureau will assist banks in determining credit worthiness of their borrowers.

The bureau allows for credit information sharing among the financial institutions and other credit providers.

Those who have a reputation of failing to honour their obligations will be distinguished from those with good credit record.

This will resolve the question of how banks can differentiate bad creditors from good ones. It is important that those bank clients who have a bad reputation of failing to repay their obligations should start working on correcting their bad habits.

Once the bureaus are fully operational and your name is blacklisted, it will be difficult for you to obtain credit either from the bank, credit store, micro-finance or other lenders.

This would have negative consequences on those individuals and organisations for a long time.

It should be noted that it is easier to be blacklisted than to be struck off the black register. From the lenders perspective the creation of Credit Reference Bureau has the following advantages; reduces borrowing costs and loan delinquencies to a significant extent; enhances effective risk identification/monitoring and credit extension and ensures that credit flows to deserving borrowers at lower costs and reduces lending to those less deserving ones.

----------

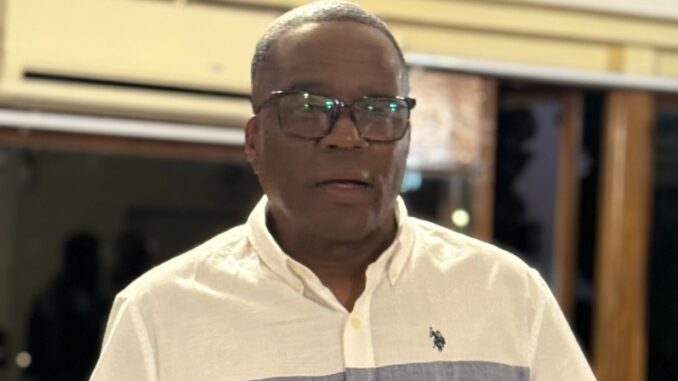

Sanderson Abel is an Economist. He writes in his capacity as Senior Economist for the Bankers Association of Zimbabwe. He can be contacted on abel@baz.org.zw or on 04-744686, 0772463008.

- Sanderson Abel I The Herald

Top Zimbabwe business executive arrested for fraud

Top Zimbabwe business executive arrested for fraud  South Africa is in serious trouble

South Africa is in serious trouble  US halts visa services for Zimbabwean nationals

US halts visa services for Zimbabwean nationals  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe Agricultural Show 2025 kicks off

Zimbabwe Agricultural Show 2025 kicks off  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick