NMB has secured $16 million new capital from foreign investors which will help the bank raise more lines of credit for deploying in areas such as mining and agriculture, group CEO James Mushore told analysts yesterday.

The bank has not been able to get into these sectors in a meaningful way because its current capital was not adequate to attract large credit lines and Mushore is hoping the relationship with the new investors will be able to assist them to get longer facilities.

The 3 strategic foreign investors that have agreed to inject $14.8 million into the group in exchange for 26.97% stake are Tunisian-based AfricInvest Capital Partners, Dutch Development Bank FMO and Norfund which is a Nowergian development finance institution.

The founder shareholders have supported previous capital raising initiatives and will support the current initiative, Mushore said.

They have agreed to be diluted significantly to allow more capital into the bank as they believe that "it is better to own 10% of an elephant than 100% of a rat".

"The genesis of this transaction is that towards beginning of 2012 when we were looking at our 2011 results... we realised that we needed to raise capital.

"Given the fact that we wanted to continue our growth story, we wanted to then raise some more equity, because the more equity you have the more debt you can raise," he said.

He said in addition to equity Norfund will provide $1.4 million in the form of a 7 year subordinated term loan which has since been approved by Reserve Bank of Zimbabwe as Tier II capital.

The equity investment has a conditional buyback option.

"The buyback essentially is to satisfy the liquidity requirements of the investors. As you know private equity players come in for a fixed time horizon; once they have achieved their objectives then they look on to exit," he said.

Mushore highlighted that the buy-back pricing that they have "is the worst-case scenario" as the buy-back options are meant to provide a worst-case exit plan and satisfy compliance requirements of the proposed strategic foreign investors.

"But in the event that they ask us to buy them back, we can buy them back at pricing which is the original price of $0.1430 plus a return compounded at 10% for the first 5 years and 5% from year 6 to 9.

He said the pricing is competitive given the current operating and political conditions in the country.

"The other thing is that any dividends that we pay from now until the options exercise come off the pricing," he said.

He also added that the buyback option is exercisable from 5th and 9th anniversary provided there are excess reserves over and above the minimum regulatory capital requirements.

Commenting on the $100 million capital base requirements by the RBZ by June 2014–in a phased manner, Mushore noted that their proposal included compliance at the end of 2015 and that has been approved.

"We raised $15 million plus some asset disposals, another $5 million; our capital will be up to $45 million and we hope to be able to trade in towards compliance for the June 2013 number which is $50 million.

"We are targeting full compliance with $100 million by December 2015 as per our plan approved by the RBZ...We don't have to comply with the $75 million deadline; our approval was to comply with $25 million, $50 and a $100 million so we ignore the $75 million. At the close of this transaction we will have the money and from there on we want to grow organically," he said.

Mushore noted that capital will come from retained earnings in the period to 31 December 2015.

"I think we will retain the confidence of our stakeholders if we are seen to be complying with whatever the regulators say," he added.

The bank was able to get indigenisation approval for the transaction and complies with the required 51% of the bank's posted transactions owned by indigenous shareholders.

Mushore also said that deals to dispose assets were completed and one of the assets they had was a piece of land in Borrowdale which has been sold.

However, he was cautiously optimistic about the business and political outlook.

"If we get the politics right then investors will be piling in here to try and get a piece of a lot of undervalued assets… So with that will come the upsurge in ZSE, I think as seen in January there was a lot of optimism given the fact that the constitution appears to be agreed on by the parliamentarians.

"So the pricing on the ZSE, all things being equal will be attractive," Mushore said.

He said all things being equal they reckon that by end of this year they will be able to raise at least $50 million worth of lines of credit.

"When you achieve full compliance, to be able to get your capital to work you need to leverage your capital at least 8-fold, so that's the sort of magnitude we will be looking at to be able to increase our capital 8-fold in terms of debt going forward.

"By having these names on our shareholding profile it will certainly help open more doors in Europe and they themselves being deep pocketed institutions will be able to increase the line. We already have a $10 million line from FMO and we expect that we will be able to unlock a lot more," Mushore said.

He said if the currency changes the repayment will be in whatever currency the country will be using at that time with the exception of the $1.4 million loan from Norfund which is supposed to be paid in USD.

- zfn

Zimbabwe launches new airline

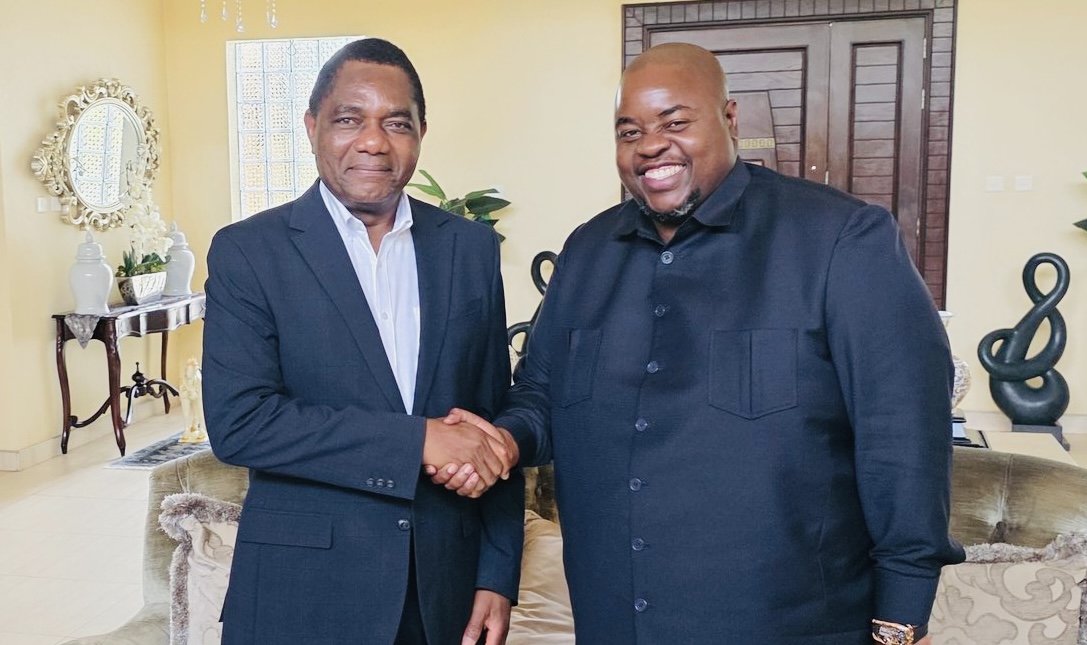

Zimbabwe launches new airline  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  SA bitcoin firm mulls Zimbabwe listing

SA bitcoin firm mulls Zimbabwe listing  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Airlink applies for Lanseria to Harare, Bulawayo route

Airlink applies for Lanseria to Harare, Bulawayo route  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick