Old Mutual's multi-million-dollar low-cost housing project in Harare's Budiriro suburb, which is ostensibly meant for low and medium income groups, might end up marginalising its target market due to high costs.

A total of 3 102 housing units are being constructed in the high-density suburb as part of the US$62 million housing project, while 15 000 units are planned countrywide.

The houses, comprising one-bedroomed and two-bedroomed structures, will be sold to qualifying individuals by mortgage through OM's subsidiary, the Central African Building Society (Cabs).

However, in an economy plagued by high formal unemployment and meagre incomes in the informal sector, the average cost per unit of between US$22 000 and US$27 000 is undoubtedly too expensive for most low-income earners.

Also, a monthly income of US$900, the basic minimum for accessing the 10-year mortgage, is out of the range of most civil servants who constitute the bulk of the local workforce. The lowest paid public worker earns a salary of US$297 per month. This is the most commonly used benchmark for low-income earners.

For the current project, monthly mortgage payments are pegged between US$240 and US$306. Those in the informal sector who fail to produce proof of employment are ineligible for the mortgage.

A recent report by the Zimbabwe National Statistics Agency, the 2011-2012 Poverty Income Consumption and Expenditure Survey, indicates that paid permanent employees stand at 15,2 percent of the population.

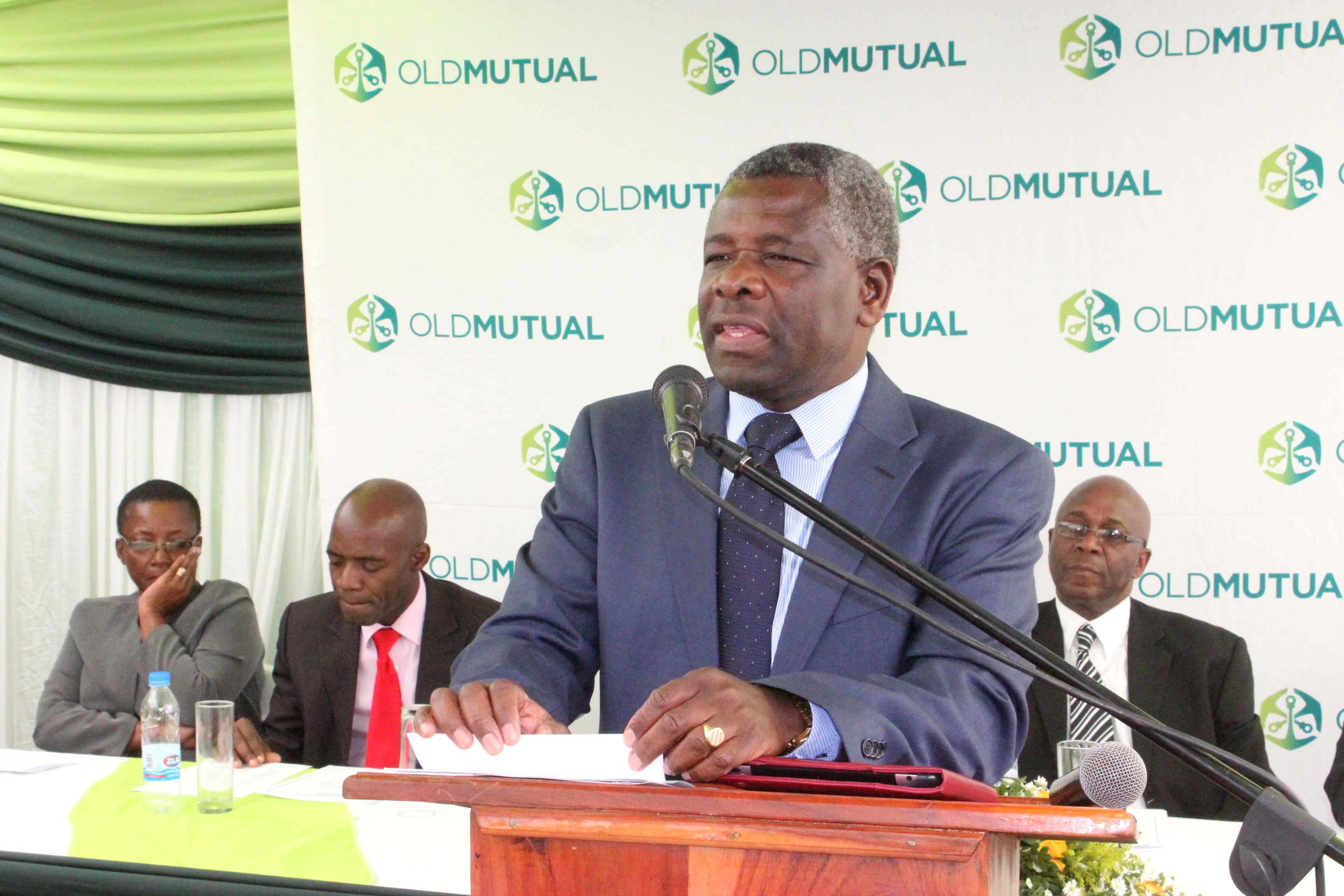

In an interview during a tour of the Budiriro project last week, Old Mutual group chief executive Mr Jonas Mushosho noted that although the underlying idea was to help low-income earners acquire descent accommodation, soaring costs had bloated prices.

He blamed the Harare City Council for failing to meet its end of the bargain, which resulted in Old Mutual taking up those costs, contrary to initial agreements.

"We would have wanted this to benefit more people in the low-income bracket, but there are issues beyond our control. We were not only building the houses, we also had to do infrastructure development and this means we incurred more costs," said Mr Mushosho.

"The City of Harare could not service the land, and we intervened to make sure that people who bought houses in the area have proper facilities such as a good road network, sewer lines and water pumps," he said. Cabs business consultant Mr Ambros Matika, however, said it was possible for couples to combine their incomes in order to meet the minimum salary requirement.

"We fully understand there are lots of people in the informal sector who may feel left out. They may just bring copies of bank statements to show they are really capable of raising the money to cover the mortgage. Copies of receipts, for instance, or share certificates can be used," he said.

Old Mutual's housing development represents one of the major private sectorfunded projects in Zimbabwe.

Housing delivery has remained a huge challenge to both Government and local authorities. Currently, there are more than one million home seekers on the national waiting list.

Since dollarisation, working capital has been a challenge for most companies with others resorting to borrowing at unsustainable interest rates or significantly scaling down operations.

The Confederation of Zimbabwe Industries manufacturing sector survey report for 2013 shows capacity utilisation in the manufacturing sector dropped to 39,6 percent from 44 percent in 2012.

Pressure on housing infrastructure and land in urban areas has over the years been fanned by population growth and migration. The increase in demand for land has consequently pushed prices up, leaving low-income earners struggling to acquire decent housing.

On average, prices for serviced land in Harare's high, medium and low density areas stand at US$25, US18 and US$15 respectively per square metre.

- Sunday Mail

Mnangagwa to officiate at Mine Entra

Mnangagwa to officiate at Mine Entra  South African ambassador falls to death from Paris hotel room

South African ambassador falls to death from Paris hotel room  India dumps US Treasury bills

India dumps US Treasury bills  Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45%  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe gold prices move to 118.26 per gram

Zimbabwe gold prices move to 118.26 per gram  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick