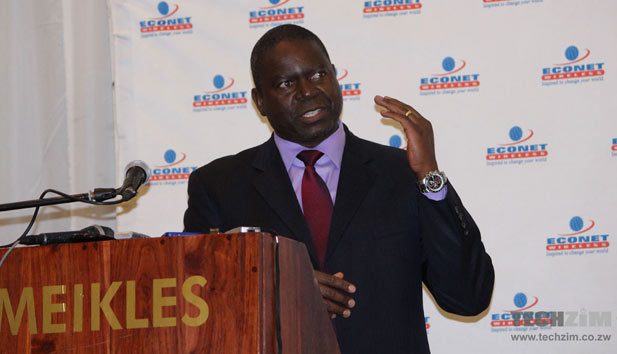

Econet Wireless CE Douglas Mboweni told an analyst briefing yesterday that the group's future lies in broadband and overlay services (Ecocash) after recording a rare decline in revenue from the mainstream voice business as competition intensifies with mobile penetration rate at 103%.

Presenting the F14 results Mboweni said going forward the group will focus on investment, innovation and revenue diversification.

"There are some fundamental areas of strategy that we're focusing on that basically enable us to define our goals. Investment into the network is critical. We cannot afford not to invest.

"Product innovation and service excellence; these have to continue…" he said.

Commenting on revenue diversification, he said they are "digging new ground" as they are seeing slowing down in other areas.

"We're taking advantage of the investment that we've put in the ground and at this stage we're talking about broadband and overlay services," said Mboweni.

Giving other areas of strategic focus, Mboweni said Econet will also prioritise process efficiency and cost optimisation as well as "improved product/service margins" for enhanced profitability.

Mboweni noted that the group's overlay services are now well established as they see more innovations coming up.

"We have to ride the wave of technology to make sure that it brings the value and also that we're able to sustain the value that we've created. We're saying basically as Econet Broadband and EcoCash or overlay services are well established in the market as we see more innovation coming up, we have to dig the ground for new and more products.

"That's why you'll see that we've EcoFarmer and EcoSchool and more products are actually lined up," he said.

He further stated that Steward Bank has been strategically positioned to promote the business areas of growth that is broadband and mobile banking services.

"Steward Bank is a critical platform into where we're going because as we see the slowing down… with mobile penetration rates at over 103% there is limited scope for growth in voice and SMS through customer acquisition in line with international trends," he noted.

Mboweni indicated that as we go into the future, "more and more" people will begin to see the value that this entity has got.

"I don't believe that EcoCash would be where it is today without that fundamental platform we have in Steward Bank," he added.

Giving the financial highlights, group chief finance officer Roy Chimanikire said the group managed to achieve 8% growth in revenue to $752.7 million attributed largely to growth in their broadband services and mobile money transfer system.

EcoCash revenue went up 307% to $33.4 million contributing 5% to the total revenue while data contribution increased by 62% to $72.4 million.

"You'll also note a steady Capex level ($140 million against $148 million) and this is all in line with our strategy of growing the non-voice revenue driven services," he said.

Under the revenue contributions, financial services contributed 5% versus 2% in the prior period, data 10% against 6%, airtime sales 58% from 65% and SMS 4% versus the previous 6%.

Chimanikire told analysts that broadband revenue was driven by increase in data capable devices and investment in infrastructure.

He also added that low smart device penetration presents a significant opportunity while access to credit through Steward Bank is expected to stimulate further increase in smart phone from penetration.

Moving on to the EcoCash revenue, he stated that transaction volumes increases were driven by the group's diversity of product range, strong brand affinity, convenience and functionality.

Chimanikire said the group's "strategic alliances with banking partners is yielding results" while agent network, currently standing at more than 10 000 agents is a key strategic advantage.

EBITDA increased by 10% to $332.2 million and as stated by Chimanikire, the impact of financial services, data and other new revenue streams on EBITDA continues to grow.

He further mentioned that full potential of new revenue streams is still to be realised. Meanwhile, EBITDA margin increased by 1% to 44%.

Operating costs went up 11% to $436 million as they carried out cost rationalisation exercises focusing on network and IT cost optimisation; supply chain management and centralised procurement; marketing and distribution costs; and hybrid power systems to reduce fuel costs.

Econet's network investment went down 5% in the period under review to $139.7 million while PAT decreased to $119.3 million against the previous $139.9 million.

"PAT is not reflective of true cash flow growth due to increase in depreciation and amortisation," he noted.

The group's total assets grew by 16% to $1.173 billion and concerning the restructuring of the balance sheet, Chimanikire said they hope to reduce their debt and maintain a capital structure that is optimal for the business.

Regarding forecasts, Chimanikire said their board has taken a decision in light of the uncertainties in the environment not to give any predictions for their business.

Econet holds 66% market share by subscriber base against 16% by NetOne and 18% by Telecel with their connected subscribers increasing by 10% to 8.782 million from 8 million.

Giving the operational highlights, Mboweni noted that there was a 31% rise of registered customers under Eco Broadband to 4.2 million and 124% increase in usage.

He noted that there will be a "continuous review of data bundles structure to align with market developments."

Ecocash recorded a 67% increase in registered customers to 3.6 million, 166% increase Ecocash payroll customers, 55% increase in bill payments via Ecocash ad 84% increase in number of Ecocash merchants.

On their relationships with banks Mboweni said the current misunderstanding on the use of their platform is a "storm in a teacup" and believes it will be resolved. He said all banks are allowed to use EcoCash for their mobile money transfer system while those who want direct access through USSD should be willing to pay the full cost of the service. On agency sharing he said Econet is opposed to parasitic tendencies by some players keen on utilising infrastructure developed by Econet adding that they prefer swopping agents with peers in the industry.

- zfn

OK Zimbabwe posts US$17,8 million loss

OK Zimbabwe posts US$17,8 million loss  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  Econet Zimbabwe to delist from ZSE

Econet Zimbabwe to delist from ZSE  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Mnangagwa fires Chitando, appoints Polite Kambamura

Mnangagwa fires Chitando, appoints Polite Kambamura  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick