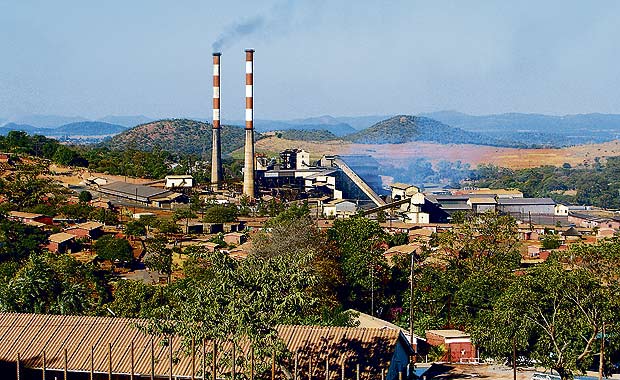

BINDURA Nickel Corporation's long road to recovery, which included five difficult years under care and maintenance, culminated in a strong return to profitability, thanks in part to the firming international nickel prices.

BNC was placed under care and maintenance in 2008 at an average cost to the group of between $800 000-$900 000 a month but a rights issue in 2012 and an approved creditors plan allowed the restart in February last year.

This restart saw the group post a record $65 million in revenue to March 31 after returning to production last year. BNC sold 82 000 tonnes of concentrates containing 7 129 tonnes of nickel.

BNC achieved an average price of $14 493 per tonne. The concentrate was exported under the off-take agreement with Glencore. Total cash operating costs averaged $13 988 per tonne and were at $12 220 per tonne in the last quarter.

Operating margins were healthy at 26,6 percent. Cash generation significantly improved due to the better operating performance although working capital requirements ($10,1 million) remained high due to ramp up in production.

About $5,1 million of the working capital was used to settle legacy creditors. BNC repaid $2 million of the shareholder loan. Capital expenditure for the period was $7,1 million. BNC expects nickel prices to remain firm at above $18 000 per tonne mainly due to the ban on exports from Indonesia and a reduction in nickel surplus. At full production cash costs are expected to range between $13 000 per tonne and $14 000 per tonne.

The results are not comparable with those of the previous financial year as the company was not fully operational. As such, comparatives with the prior period are misleading as operations at its Trojan Mine in Bindura only resumed in December while Shangani Mine, the smelter and refinery remains under care and maintenance.

Operating profit of $17,3 million against the preceding year's loss of about $13,1 million while net profit was at $23,6 million. Bindura's share price on the Zimbabwe Stock Exchange has in the year to date gained 125 percent. The miner traded 0,2c firmer to 4,5c yesterday.

It has solely been responsible for the strong gain on the Minings Index which is closed at 56,97.

BNC announced plans to refurbish the smelter at a cost of $26 million, taking advantage of the firm nickel prices (for cash flows).

According to management, approximately 50 percent of the costs will be internally generated with the balance being debt financed.

After re-entering the ranks of nickel producers with significant production and profit performances that hold promise for its future, BNC is now generating strongly positive cash flows and is set to do so even at nickel prices lower than those currently prevailing.

Trojan Mine, which had been under care and maintenance since November 2008, resumed production of nickel in concentrates and made its first delivery in terms in April 2013. And, during the current year, smelter operations will resume to produce nickel leach alloy, adding to the company's revenues and operating profit.

Although the company has returned to profit, the board believes that the declaration of a dividend would be premature.

"Financial resources are being husbanded to facilitate the funding of future development projects," said the company.

"After the smelter's resumption, the next major project is the possible establishment of mining operations at the 200Mt Hunters Road resource near the town of Gweru. The project's viability is being evaluated. The board remains confident that the company will sustain a profitable future along with the capacity to take on expansion projects timeously."

Nickel markets remained depressed for much of the year under review, but spot nickel prices rose strongly when Indonesia, one of the world's leading nickel producing countries, prohibited the export of unprocessed concentrates. Indonesia's aim is to increase domestic beneficiation of its minerals, an objective being pursued by the governments of several countries whose economies rely on the production of primary products. Bindura's re-opening of its smelter supports the Zimbabwean Government's policy of encouraging domestic beneficiation of the nation's minerals.

Several metals analysts predict that, apart from minor periods of volatility, international nickel prices are likely to remain in the region of current levels until 2017.

At that stage, with the world's economic recovery likely to be firmly established and demand for metals strong, nickel prices are expected to increase. Despite this positive outlook, the company will persist in its efforts to contain costs and to generate cash flows that will allow it to fund future projects internally. There is no intention to call on shareholders for equity funding.

- The Herald

Zimbabwe announces strict enforcement of axle load limits

Zimbabwe announces strict enforcement of axle load limits  SA decry 'non-existent' Beitbridge border post security

SA decry 'non-existent' Beitbridge border post security  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45%  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Karo Platinum Project capex rises to US$546m

Karo Platinum Project capex rises to US$546m  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick