ZIMBABWE'S new government talks up the country's mineral wealth in its push for investment, as it seeks to snap a run of sluggish economic growth, an official document shows.

The country's tilt towards resource nationalisation under former president Robert Mugabe, saw foreign investors giving the country a wide berth. Mugabe's signature policies - the seizure of white-owned farms to resettle landless blacks and his drive to localise ownership of major businesses - are blamed for Zimbabwe's lagging behind its regional peers in attracting foreign direct investment.

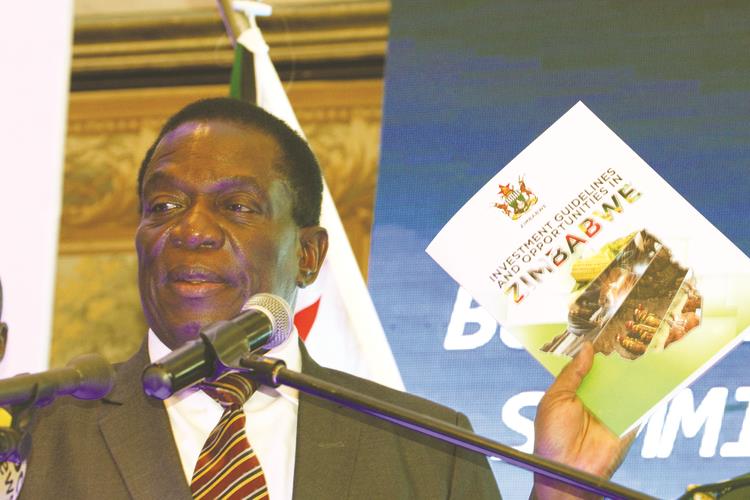

President Emmerson Mnangagwa, who took over in November after Mugabe was forced to resign under pressure from the military and the ruling party, has embarked on an aggressive offensive to court foreign investors. Mnangagwa, who won a rare invitation to this year's World Economic Forum meeting currently underway in Davos, Switzerland, has relaxed the law requiring majority local shareholding in major businesses, with the exception of diamond and platinum mining.

A document produced by government in the run-up to Davos, showcases opportunities in the mining sector, a major source of employment and foreign currency for the country. The document showcases more than 60 minerals that could be exploited to drive economic growth. The Investment Guidelines and Opportunities in Zimbabwe document, which was unveiled by Mnangagwa last week, shows that government has pinned recovery hopes on mineral exports and agriculture.

Mining has the potential to make the country a significant player in global trade, earning over $2 billion in 2017. Government says the economy will grow by 4,5 percent this year. The African Development Bank, however, expects the economy to grow by one percent this year, picking up to 1,2 percent in 2019. The World Bank says Zimbabwe's economy will grow by 0,9 percent this year.

"Mining is the major attraction of the country with over 60 international tradable minerals. Zimbabwe has the second highest deposits of platinum in the world," the document said. It said major mineral belts include the Great Dyke belt, which harbours platinum group of metals, chrome and gold. Coal fields include the Beitbridge-GokweHwange belt. Diamonds are in abundance in Marange but are also available in different parts of the country. Mineral export receipts are projected to grow eight percent to $2,5 billion this year from $2,3 billion last year driven by anticipated output growth and modest recovery in international prices, according to Finance and Economic Planning Minister Patrick Chinamasa.

Presenting the 2018 National Budget last month, Chinamasa said mining output was expected to grow 6,1 percent this year. Of the over 60 minerals about 40 are currently being exploited. Zimbabwe boasts of the world's largest deposits of chrome, second largest deposits of platinum and huge deposits of other minerals such as gold, copper and nickel. With such minerals the country could adopt domestic resource mobilisation because it is more sustainable and predictable than foreign aid that comes with preconditions and perpetuates Zimbabwe's indebtedness.

- fingaz

Zimbabwe launches new airline

Zimbabwe launches new airline  Hichilema meets Chivayo

Hichilema meets Chivayo  Millions celebrate Diwali festival in India

Millions celebrate Diwali festival in India  SA bitcoin firm mulls Zimbabwe listing

SA bitcoin firm mulls Zimbabwe listing  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Airlink applies for Lanseria to Harare, Bulawayo route

Airlink applies for Lanseria to Harare, Bulawayo route  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick