THE politically well-connected Cypriot Pouroulis family - which is close to President Emmerson Mnangagwa - and is associated with speculation in mining has hit the jackpot in Zimbabwe.

After clinching a dodgy US$4,2 billion platinum investment deal with government in March through its company Karo Resources Limited, it has now acquired three vast special grants to mine chrome and other natural resources along the mineral-rich Great Dyke.

The latest deal was sealed last week.

This effectively gives them control of vast swathes of some of the most lucrative mineral concessions in Zimbabwe.

The Great Dyke hosts huge ore deposits, including gold, silver, chrome, platinum, nickel and asbestos.

Loucas Pouroulis, the business tycoon close to Mnangagwa, is notorious for speculation: in 2005 he made a fortune after acquiring South Africa's Impala Platinum subsidiary Elandsfontein Platinum Project for US$15 million before selling it two years later for a staggering US$1,1 billion to Xstrata.

While the platinum deal was dodgy and reeked of speculation, the latest chrome venture is a web of related-party transactions.

This creates a potential conflict of interest, which must be regulated as it could result in commercially prejudicial activities.

One of the most prominent examples of fraudulent use of related-party transactions is the infamous Enron scandal.

In this case, related-party transactions with "special-purpose entities" were used to help the company misreport its accounting figures.

In the latest chrome deal, which has raised questions of conflict of interest and transparency, all the companies involved in the transaction and marketing of the minerals are controlled by the Pouroulis family.

The family — which owns Tharisa Plc, an integrated resource group involved in mining, processing, beneficiation, marketing, sales and logistics — acquired 90% shareholding in Salene Chrome Zimbabwe (Pvt) Limited, paving the way for access to the country's rich illuvial chrome deposits.

But Salene's file is not available at the Company Registry in Harare as officials say the firm is not registered in Zimbabwe.

This further exacerbates the controversy.

Questions sent to Tharisa's investor relations contact Sherilee Lakmidas and financial PR contacts Bobby Morse and Anna Michniewicz last week were not responded to.

Additional questions were sent this week, but still there was no response.

Tharisa is registered in Cyprus under registration number HE223412.

It trades on the JSE, oldest and largest stock exchange in Africa, and the London Stock Exchange.

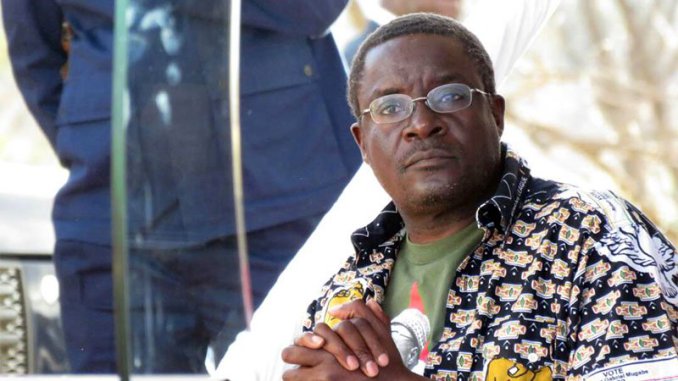

The group is controlled by Pouroulis, the executive chairman, while his son Phoevos is the chief executive.

Phoevos met Mnangagwa in January, two months after he took over the country's leadership from former president Robert Mugabe through a military coup.

He told reporters at the time the purpose of his visit was to seek investment opportunities in the country.

The chrome deal comes at a time queries are being raised over Karo Resources Limited's US$4,2 billion platinum venture after it emerged that the company has some dodgy background and dual registration in Cyprus and Guernsey, a tax haven blacklisted by the European Union.

The situation is made murkier by disclosures that Pouroulis has previously been investigated by South African authorities for alleged commercial crimes.

An announcement by Tharisa on May 16 confirmed that the group had taken control of the ghostly Salene from Leto Settlement Trust at nominal value, leaving the trust with 10%. The transaction gave the Pouroulis family greater control of the Great Dyke and access to illuvial chrome deposits.

"Tharisa has acquired a 90% shareholding in Salene Chrome Zimbabwe (Pvt) Limited at the par value thereof from the Leto Settlement Trust, a related party being the beneficial shareholder of Medway Development Limited, a material shareholder in Tharisa," Tharisa's statement said.

"The effective date of the acquisition is 15 May 2018. Leto will retain a 10% free carried shareholding in Salene and be entitled to a 3% royalty on the gross proceeds from the sale of the chrome concentrates produced.

"Salene has been awarded three special grants under the Zimbabwe Mines and Minerals Act covering an area of approximately 9 500 hectares (95km2) on the eastern side of the Great Dyke in Zimbabwe, which entitles it to mine the minerals thereon including illuvial chrome, being at surface chrome fines generated from seams as a result of weathering."

Tharisa will use its newly-acquired entity Salene to extract chrome fines from Zimbabwe, and controversially export to its subsidiary Arxo Resources Ltd — creating a web on related-party transactions and collusion.

"The nature of the special grant areas allows for a project that is a scalable open pit operation that can be brought into production on a low risk and relatively low cost basis in a short time.

Arxo Resources, the wholly owned trading subsidiary of Tharisa, will be the sole off taker of chrome concentrates produced, thereby leveraging Arxo's existing capabilities," said Tharisa.

Tharisa said Salene would apply for national project status and for its special grant areas to be contained within a proposed Special Economic Zone, indicating its desire to seek patronage from Mnangagwa's administration.

If national project status is granted, Tharisa will be able to import plant, equipment and machinery, as well as fuel into the country duty free and enjoy tax holidays.

Although Tharisa said there was insufficient information available to be able to accurately quantify the value of the net assets, the company believes it has struck gold; it will be a successful enterprise.

"Based on available geological information and similar illuvial chrome mining activities in the region, Tharisa considers this to be a highly prospective opportunity to meaningfully expand its chrome mining interests.

The terms of the acquisition agreement requiring nominal upfront payment, provides Tharisa with a low-cost entry into a promising growth project in a new mineral rich geography," the company said.

The company said the Great Dyke of Zimbabwe contains the world's largest known platinum group metals and high-grade chrome deposits outside of South Africa.

"The Great Dyke region is known to contain illuvial chrome concentrations of up to 30% Cr2O3 at surface," Tharisa said.

Salene is looking to invest US$3,2 million in geological test work over a period of 12 months, before commencing work by setting up a pilot project.

Following the acquisition of Salene, Tharisa announced it had appointed Josephat Zimba, a local metallurgist, as the country manager (Zimbabwe).

The company, however, said the transaction was "subject to compliance by Tharisa with the listings requirements of the JSE Limited as they pertain to related-party transactions."

In 2011 the state-controlled daily The Herald reported that Zimbabwe had been warned of dubious investments, including that of Pouroulis, after his company Kameni was reported to the South African Police Service's commercial crimes unit for "false claims".

The company had then been trying to raise seed capital for its projects in Kalkfontein and the Great Dyke.

The Herald — which usually reflects the official position — then went on to cite the example of Pouroulis investments.

"For instance, Kameni, a South African platinum developer led by Mr Lucas Pouroulis, is under investigation by the JSE and the South African police.

The company is facing allegations of raising millions of rand of seed capital from investors by falsely claiming ownership of part of the Bokai platinum reserves on the Great Dyke in Shurugwi and Tamboti in South Africa," it wrote.

"Without any legal document to back up its claim on Bokai, Kameni has falsely claimed rights over the Shurugwi platinum belt.

Kameni claimed that it was the holder of the mining claim in December 2008, and revealed plans to raise R6,5 billion on the JSE for the development of platinum and chrome mines in Zimbabwe and South Africa."

It was also reported that on March 5, 2009 Kameni announced that "it had raised R300 million which was its minimum capital raising requirement in seed capital to fund its exploration programme in South Africa and Zimbabwe".

Kameni, it is said, further advised that its two major assets, the near-surface Kalkfontein (Tamboti) PGM project in South Africa and the surface PGM and chrome Bokai Project in Zimbabwe, lend themselves to rapid exploration, development and cash-generating mining.

Reports show that despite its claims on the JSE, Kameni had at that time not set foot on Bokai in Shurugwi.

Attempts at geological exploration work by Kameni's Zimbabwean subsidiary, Mid-Ma, had failed within weeks of its raising millions of rand from investors.

Mid-Ma geologists were arrested on Todal claims in Shurugwi, and their diamond drill rigs were impounded.

Against this background, fears abound that the Pouroulis deals are dodgy speculative ventures entangled in complex opaque arrangements and conflict of interest.

- Zim Ind

Chiwenga confirms he reported Marry Mubaiwa

Chiwenga confirms he reported Marry Mubaiwa  The JSE is shrinking

The JSE is shrinking  UK's Boris Johnson quits over Brexit stretegy

UK's Boris Johnson quits over Brexit stretegy  SecZim licences VFEX

SecZim licences VFEX  Tobacco, gold dominate Zimbabwe's exports

Tobacco, gold dominate Zimbabwe's exports  Farmers urged to bale and not burn

Farmers urged to bale and not burn  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick