GOVERNMENT plans to scrap Aids levy and introduce a holistic National Health Fund which will draw its funds from the fiscus, bringing relief to the country's tax-burdened workers.

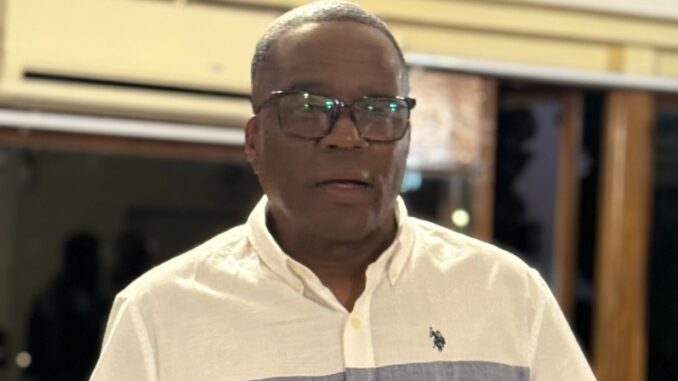

Health and Child Care Deputy Minister Paul Chimedza said in an interview yesterday that the Government was already working on modalities to scrap the Aids levy, which was introduced in 1999 to lessen the burden on workers, many of whom earn low salaries.

The levy was calculated at 3 percent of a person's income tax, rather than on the salary itself.

Apart from Aids levy, Zimbabweans also pay 3,5 percent of their salaries up to a fixed level towards the National Social Security Authority, Pay As You Earn which is at least 20 percent of taxable income above $250 (tax-free threshold), while VAT is at 15 percent, withholding tax for companies in the informal sector stands at 10 percent, and Capital Gains Tax for profits accrued from the sale of immovable property is a flat five percent.

The planned scrapping of the Aids levy comes at a time when Parliament was debating a motion to introduce a cancer levy.

"Once the National Health Fund is in place, we will no longer have things like Aids levy or cancer levy, but a single fund from where resources to fight various health care challenges will be drawn and we are working on the modalities of how the fund will operate," said Dr Chimedza.

"While we applaud the ongoing efforts in some quarters to bring to the attention of the nation the challenges being faced by people with diseases such as cancer, we feel as a ministry that there is need for a holistic approach to all health care issues in Zimbabwe and in that sense we are working on the modalities for the establishment of a National Health Fund from which money for all the country's health care programmes will come."

The deputy minister said the establishment of the National Health Fund would trigger the removal of the Aids levy.

"What we are saying is that we cannot introduce a levy for every disease that affects many people in our country, otherwise we will end up with the Aids levy, cancer levy, hypertension levy, or diabetes levy," said Dr Chimedza.

"The way to go is to just create a National Health Fund and not compartmentalise the fight against diseases.

"While the need to introduce a levy to help victims of cancer is noble, our workers are already over-taxed and burdened enough to continue piling more levies on them, hence the rationale behind a single fund to cater for all health care challenges. If we insist on more levies our workers will take home nothing."

He said proposals for the National Health Fund would be submitted to the Ministry of Finance to devise ways of raising the required funds.

With global funding for HIV and Aids on the decline, Zimbabwe's innovative Aids levy became a promising source of funding for the country, with a dramatic increase in revenue collected in the past two years.

The levy was introduced to compensate for declining donor support, but low salaries and the poor performance of industry meant not enough money had been collected.

The introduction of Aids Levy followed the enactment of the National Aids Council of Zimbabwe Act Chapter 15:14, which led to the introduction of the National Aids Trust Fund commonly known as Aids Levy.

- herald

Top Zimbabwe business executive arrested for fraud

Top Zimbabwe business executive arrested for fraud  South Africa is in serious trouble

South Africa is in serious trouble  US halts visa services for Zimbabwean nationals

US halts visa services for Zimbabwean nationals  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe Agricultural Show 2025 kicks off

Zimbabwe Agricultural Show 2025 kicks off  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick