Business Live

Australia says investing in Zimbabwe is extremely risky, likening the move to swimming in the dangerous crocodile-infested Zambezi River.

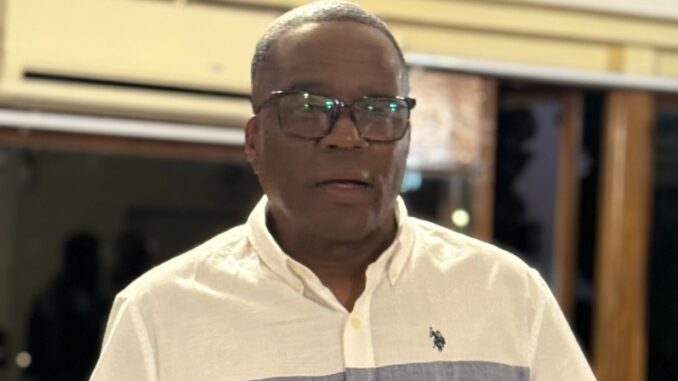

Matthew Neuhaus, the country's ambassador to Zimbabwe, on Monday told a Sapes Trust conference that the southern African nation has a long way to go in attracting Foreign Direct Investment (FDI).

"Investing in Zimbabwe is like swimming in the Zambezi between crocodiles and hippos," he said, adding that "instead of policies to encourage FDI, you have chosen indigenisation, especially in the mining sector."

He said Australian investors have found it easier to do business in Zambia and Mozambique, injecting billions of dollars in investment in their economies.

"Because of the uncertain political and economic environment, investors have skirted this country," said Neuhaus.

"Certainly, indigenisation laws have been confusing, and the implication of the 51 percent ownership does not inspire confidence in investors. They want to know that their investments are safe and that they get what they put in," he said.

He said government needs to boost confidence and attract investments, further stating that Zimbabwe's harsh business environment and corruption were some of the factors that continue to scare investors away from the country.

This comes as in March, British deputy ambassador to Zimbabwe Chris Brown said investors remained worried about the perceived lack of respect for property rights and uncertain business climate in the country.

"If the government doesn't soon articulate a really clear approach on achieving empowerment and respect property rights, Africa, I fear, will continue to rise without Zimbabwe," he said.

Brown said Zimbabwe had potential to attract more investment than most African countries but remained hamstrung by unfriendly policies and environment.

A recent report by Singapore-based Global Business Reports also ranked

Zimbabwe among the riskiest mining investment destinations despite its vast mineral wealth.

"However, certain points stood in its favour. These included last year's ‘peaceful' elections, and the undeniable mineral potential of the country," read part of the report.

Zimbabwe holds an estimated 30 percent of the world's diamond reserves as well as the second-largest known platinum deposits in the world after South Africa.

However, over the years the country has experienced a pronounced investor flight due to bad economic policies such as the land reform exercise and the indigenisation policy.

Although the southern African country has been labelled a high risk investment destination due to its political risk profile, authorities have been trying hard to prove to the world that Zimbabwe is changing for the better.

While officially opening the annual trade fair in Bulawayo last month, President Robert Mugabe assured investors that his government's aggressive empowerment policies were not ill-intentioned.

Instead, the leader said Zimbabwe's indigenisation policy had been misinterpreted.

"As originally set out, it (indigenisation) is meant to empower and integrate the majority of our people into the mainstream economy. The policy aims at achieving inclusive growth, sustainable development and social equity," he said.

- dailynews

Top Zimbabwe business executive arrested for fraud

Top Zimbabwe business executive arrested for fraud  South Africa is in serious trouble

South Africa is in serious trouble  US halts visa services for Zimbabwean nationals

US halts visa services for Zimbabwean nationals  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe Agricultural Show 2025 kicks off

Zimbabwe Agricultural Show 2025 kicks off  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick