Latest News

Top Story

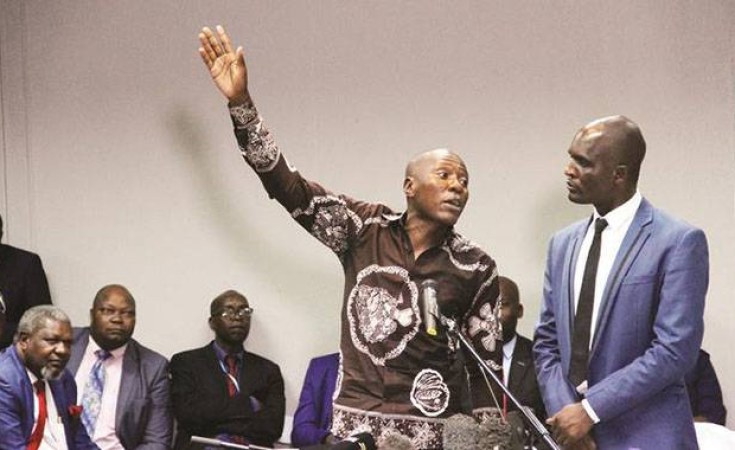

'Zimbabweans paying 15 different taxes'

'Zimbabweans paying 15 different taxes' Former Finance Minister Tendai Biti has accused the government of overtaxing citizens, claiming that Zimbabwe is now th...

Top Story

ZEP holders face renewed uncertainty

ZEP holders face renewed uncertainty As the November 2025 expiry date for the Zimbabwe Exemption Permit (ZEP) approaches, thousands of Zimbabwean nationals ...

Top Story

US reaffirms tough visa rules for Zimbabweans

US reaffirms tough visa rules for Zimbabweans The United States has reiterated its strict position on visa processing for Zimbabwean residents, confirming that all n...

Top Story

ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half Zimbabwe's equity markets had a subdued first half of 2025, with the Zimbabwe Stock Exchange (ZSE) shedding 3% in real ...

Top Story

Gold edges up as traders await guidance

Gold edges up as traders await guidance Gold edged higher as traders weighed the outlook for US monetary policy ahead of a key speech by Federal Reserve Chair J...

Top Story

Demand surges for Harare-Mutare flight

Demand surges for Harare-Mutare flight The newly launched Harare - Mutare airline service is expected to grow sustainably on the back of rising interest from ...

Top Story

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019 Company Name Investec Asset Management Company Location Cape Town, Western Cape, South Africa Click HEREJob descriptionO...

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick