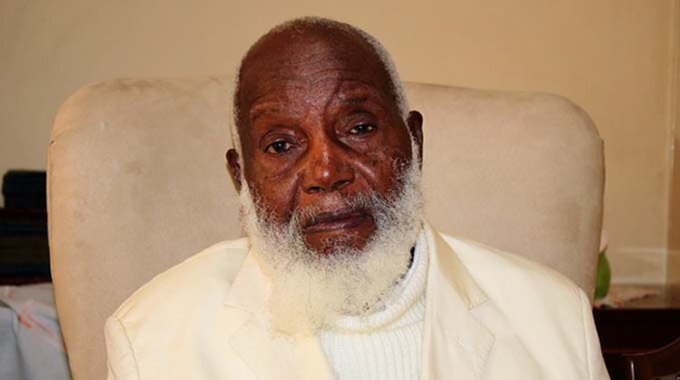

CBZ Holdings is targeting a 15% growth in the bank's total deposits for the 2014 full financial year, newly appointed group CE Never Nyemudzo told the AGM on Wednesday.

"Our forecast into the remainder of the year remains as advised in February this year: 15% growth on deposits, 9% on advances as we continue to restrain in terms of credit creation in support of liquidity.

"Going forward we will continue to expand contribution by other non-banking subsidiary units in which we're chasing 20% target. We will also continue to unlock value on our land-bank with special focus on housing," he said.

Nyemudzo noted that the first quarter to 31 March 2014 was "largely characterised by liquidity challenges which increased the cost of doing business primarily the increased cost of funds in the bank."

As a result, he said they are seeing pressure on the customers to meet their obligations on time and in response to that Nyemudzo added that the group is going to strengthen their customer relationships, enhance collection efforts on all overdue debts and their effort in expanding long term deposits.

During the quarter, the new CE mentioned that they started the first phase of the 1 095 stands in Gweru Nehosho high density suburb.

"The cost of doing this project is approximately $8 million and the process will take about 8 months after which the second phase which involves construction of core houses will begin," he said.

The CBZ Bond is "progressing well" and they have retired the maturity on $68 million 2 weeks back and now they are at an advanced stage to raise the renewal at a higher level of $200 million.

"The group continues to enjoy significant capital buffers with the bank sitting at $161.8 million compared to the $25 million required by the central bank. Asset management, four times above the minimum required; CBZ Life 6 times above the minimum required..." he added.

Nyemudzo stated that activity during the period under review was very low and as a result there was a 7.6% decrease in total income to $34.4 million.

"We will continue with our efforts to enhance the quality of our earnings and as a result you will see our impairment charges increasing by 32% to close the quarter at $3.8 million. Our bottom-line (PAT) shed off 43.7% to close at $5.8 million," noted the CE.

He pointed out the significant growth on the balance sheet as total assets went up 30.7% to $1.660 bln while deposits closed 36% higher at $1.425 bln and advances 15% up.

Moving on to the key ratios, Nyemudzo noted that the loan to deposit ratio closed at 78.3% against 89.6%, liquidity at 32.5% versus 38.1% and cost to income was 67.8% against 56.9%.

"We'll continue to support the liquidity thrust and high asset performance. As such we will restrain in terms of our lending; cost management will remain a focus area and as a result our liquidity ratio continued above the 30% required by the central bank," he said.

The group's directors were re-elected with their fees set at $640 075 whilst auditors Deloitte and Touche were reappointed with fees of $634 116 approved.

- zfn

Opposition vows to resist Zanu PF's 2030 plan

Opposition vows to resist Zanu PF's 2030 plan  South Africa ripe for a coup

South Africa ripe for a coup  India dumps US Treasury bills

India dumps US Treasury bills  Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45%  Gold edges up as traders await guidance

Gold edges up as traders await guidance  fastjet introduces Bulawayo-Victoria Falls flights

fastjet introduces Bulawayo-Victoria Falls flights  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick