Zimbabwe's High Court has dismissed businesswoman Jane Mutasa's bid to block the sale of Empowerment Corporation (Private) Limited (EC)'s 40 percent stake in Telecel Zimbabwe (Private) Limited (Telecel), thus further muddying the investment firm's boardroom wars.

The ruling, however, comes as the government has threatened to cancel the mobile operator's licence and EC shareholders - notably James Makamba and the Indigenous Business Women's Organisation (IBWO) founder - had already cancelled a February 20 extraordinary general meeting (EGM) to ratify the deal with Brainworks Capital Management (BCM).

In a recent judgment, Justice David Mangota threw out Mutasa, Selpon Investments (Private) Limited (Selpon) and Magamba Echimurenga's urgent application - with costs - on the basis that there are "material disputes of fact, which need to be ventilated in a proper court action".

"Further evidence, which can only be adduced through a court action is required. That evidence takes the entire matter outside applications of the present nature," he said.

"The parties are… required to go back to the drawing board. Viva voce evidence must be called to assist the court in the determination of the authenticity or otherwise… The court is satisfied that the application cannot be conclusively dealt with in the face of material disputes, which the parties raised," Mangota said.

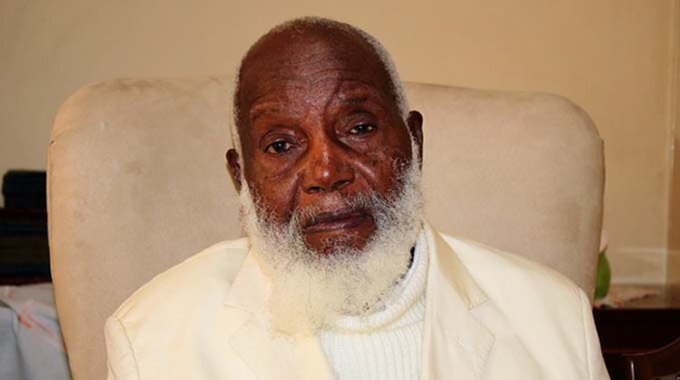

While the court's ruling has come as a hammer blow to Mutasa's quest to assert her rights and side-line Patrick Zhuwao, the development also comes as the EC managing director's brother Leo Mugabe has branded Mutasa, Makamba and fringe player Philip Chiyangwa "crooks" for swindling other shareholders.

As well as Information and Communication Technology minister Supa Mandiwanzira's statements, Mugabe's involvement has all, but confirmed that the Telecel wars have become political.

What is not clear, though, is whether Mangota's ruling will compel Makamba and company to reinstate the EGM as well as the BCM transaction to dispose of 80 million Telecel shares.

On its part, EC had on February 19 cancelled the proposed EGM to transact the BCM deal.

"…the meeting will not proceed. An appropriate notice convening any further general meeting…will be addressed and notified in the prescribed manner for the members of the company, should the need so arise," it said in a notice listing Makamba's Kestrel Corporation, IBWO, Selpon and National Miners Association of Zimbabwe as the sole legitimate shareholders.

While Mutasa had approached the courts to stop the $20 million transaction with BCM, Zhuwao also made some startling revelations that Telecel was "technically insolvent" and needed $300 million in recapitalisation funds.

In his opposing affidavit, the ex-Zanu PF legislator said "audited financial statements of Telecel Zimbabwe for the year ending December 2013 show clearly that the total assets of Telecel Zimbabwe are $216 million".

According to Zhuwao, the mobile operator's current and non-current liabilities, were in the region of $203 million, thus leaving a net asset value (NAV) of less than $15 million, adding that "the financial position has since then significantly deteriorated to an equity (NAV) position of less than $100 000, by end of 2014".

In her papers, Mutasa had queried the former's locus standi in seeking to dispose off the 80 million Telecel shares - held by EC - to BCM and whether minority shareholders would get full value of their money.

"The ... applicants stand to lose all their lifetime investment they had made in Telecel… through the 6th respondent (EC)… which has ever increasing value well in excess of $200 million and is sought to be donated or be given away for as little as $20 million," she said.

Meanwhile, Makamba has challenged War Veterans minister Chris Mutsvangwa to produce evidence of how deposed ex-vice president Joice Mujuru had funded him and ordered the loquacious businessman to retract his statements - printed by the Chronicle - recently.

- dailynews

Zimra imposes US$2m penalty on OK Zimbabwe

Zimra imposes US$2m penalty on OK Zimbabwe  South Africa ripe for a coup

South Africa ripe for a coup  India dumps US Treasury bills

India dumps US Treasury bills  Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45%  Gold edges up as traders await guidance

Gold edges up as traders await guidance  fastjet introduces Bulawayo-Victoria Falls flights

fastjet introduces Bulawayo-Victoria Falls flights  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick