Latest News

Top Story

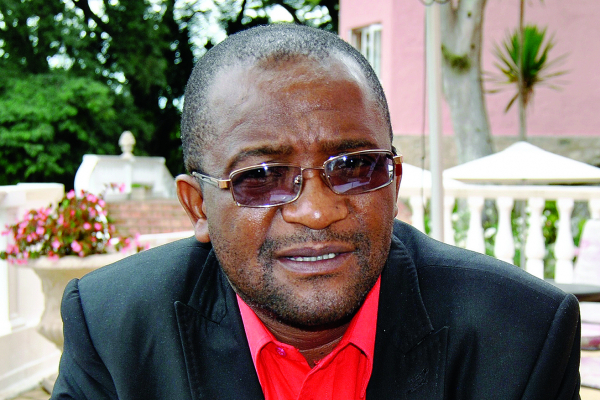

Mwonzora faces arrest

Mwonzora faces arrest MDC-T president Douglas Mwonzora has reportedly had a warrant of arrest issued against him for defaulting on child maint...

Top Story

Starlink plans to go big in South Africa

Starlink plans to go big in South Africa Starlink, the satellite internet company owned by SpaceX, has announced its plans to launch services in South Africa, w...

Top Story

'Some very strange things are happening in China!'

'Some very strange things are happening in China!' President Donald Trump has threatened to pull out of an expected meeting with President Xi Jinping of China after Beijin...

Top Story

Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45% Zimbabwe's dollar-only stock market is riding a wave of gains, powered by gold miners cashing in on a 48% jump in the p...

Top Story

Gold edges up as traders await guidance

Gold edges up as traders await guidance Gold edged higher as traders weighed the outlook for US monetary policy ahead of a key speech by Federal Reserve Chair J...

Top Story

Gold shatters $4,000 milestone

Gold shatters $4,000 milestone Gold surged past the $4,000 an ounce level for the first time on Wednesday, building on a record-breaking rally as broad...

Top Story

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019 Company Name Investec Asset Management Company Location Cape Town, Western Cape, South Africa Click HEREJob descriptionO...

.jpg)

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick