Latest News

Top Story

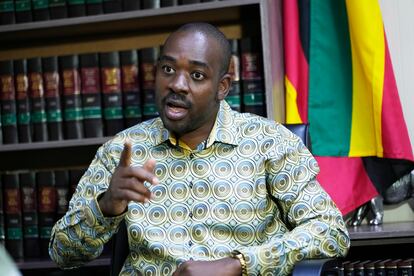

Chamisa rejects coup-like actions

Chamisa rejects coup-like actions Zimbabwe's main opposition leader, Nelson Chamisa, has made it clear that he will not support any actions resembling the...

Top Story

ZEP extension faces pushback

ZEP extension faces pushback The South African government has extended the validity of the Zimbabwean Exemption Permit (ZEP) until May 28, 2027, a m...

Top Story

'Some very strange things are happening in China!'

'Some very strange things are happening in China!' President Donald Trump has threatened to pull out of an expected meeting with President Xi Jinping of China after Beijin...

Top Story

Zimbabwe's dollar stock exchange surges 45%

Zimbabwe's dollar stock exchange surges 45% Zimbabwe's dollar-only stock market is riding a wave of gains, powered by gold miners cashing in on a 48% jump in the p...

Top Story

Gold edges up as traders await guidance

Gold edges up as traders await guidance Gold edged higher as traders weighed the outlook for US monetary policy ahead of a key speech by Federal Reserve Chair J...

Top Story

Zimbabwe named World's best country to visit in 2025 by Forbes

Zimbabwe named World's best country to visit in 2025 by Forbes Zimbabwe has been crowned the world's best country to visit in 2025, according to Forbes magazine, a recognition that u...

Top Story

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019 Company Name Investec Asset Management Company Location Cape Town, Western Cape, South Africa Click HEREJob descriptionO...

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick