NEGOTIATIONS between the Industrial Development Corporation of Zimbabwe (IDCZ) and South Africa's largest development finance institution, IDC, for a $10 million bailout have collapsed, a senior executive has said. The State-run Zimbabwean concern, whose interests cut across industries, has been courting its South African counterpart to recapitalise several of its ailing subsidiaries.

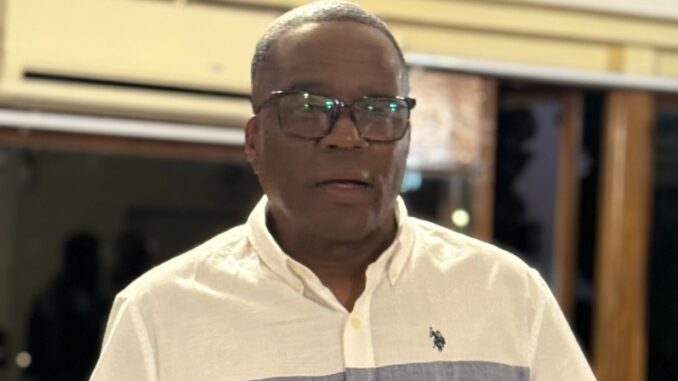

It has also been seeking offshore finance to purchase water treatment chemicals for the Zimbabwe National Water Authority (ZINWA). IDCZ negotiated the $10 million transaction in 2010 and signed a Memorandum of Understanding with the South African financial institution. IDCZ chief executive officer, Michael Ndudzo told the Financial Gazette on Monday that the South African institution is now backtracking from the deal.

He blamed targeted sanctions imposed on Zimbabwe by Western powers for the development.

"The deal for $10 million meant for retooling Zimphos (Zimbabwe Phosphates Industries) and Dorowa (Minerals), to step up production of phosphatic fertilizers and water treatment chemicals for all urban councils and ZINWA has fallen through," said Ndudzo.

"It's because of sanctions," he said.

While IDCZ has been left out in the cold by its South African counterpart, the 74-year old development lender has not stopped pursuing other opportunities in Zimbabwe. Reports say another State-run firm, the Infrastructure Development Bank of Zimbabwe, had accessed funding from IDC South Africa. This tends to suggest that there could be more to it than just sanctions, that contributed to the collapse of negotiations between IDCZ and IDC.

The tragedy is that the firms earmarked for funding by IDCZ play a crucial role in social service delivery in Zimbabwe. Their continued undercapitalisation will have the effect of prolonging a social service delivery crisis characterised by water shortages, uncollected garbage and poor roads. Zimphos produces water treatment chemicals, while ZINWA manages water for the State. Its mandate encompasses the capitable distribution of the country's water at affordable prices.

IDCZ has been facing challenges in mobilising lines of credit as it remains under the sanctions list of the Office of Foreign Assets Control, an agency of the United States Department of Treasury. It has also been affected by Zimbabwe's high country risk, which has discouraged potential funders from extending lines of credit to local companies. With the IDC deal now off the table, Ndudzo and his team are exploring other alternatives.

The State-owned conglomerate is understood to be in talks with a potential suitor as it struggles to pay off CBZ Holdings, through which it raised $13,5 million in diaspora bonds two years ago. The funding was for recapitalising its subsidiary, Surface Investments. Recently, Ndudzo told C&M that IDCZ was courting suitors for $140 million to recapitalise its ailing subsidiaries and stimulate production. He admitted, however that the fact that IDCZ was on the US sanctions list meant that securing funding from external sources could be an uphill task.

"As you might know our shareholder, which is government, has no capacity at the moment to recapitalise operations. Remember also that we are under undisputed restrictions and we are handicapped. We have been trying to mobilise capital but because we are still on the US sanctions list and also having to deal with the country's poor risk premium, it has been difficult for us," said Ndudzo.

One of the few State-owned firms to have consistently declared dividends since independence in 1980, IDCZ's fortunes were affected by an unprecedented economic crisis that swept through the country during the decade to 2008, dealing a body blow to industry and ravaging the economy, now without a domestic currency and grappling with a liquidity crunch. IDCZ has been affected by a cash crisis triggered by declining revenues and heavy losses.

For the year to December 31, 2012, IDCZ incurred a loss of $20,8 million against a loss of $10,7 million the previous year. The group had significant borrowings amounting to about $79 million of which nearly $42 million was due in 2013. Government, the sole shareholder in IDCZ, has been unable to bail out the investment company with cash to allow it to recapitalise a number of its subsidiaries due to budgetary constraints. IDCZ controls more than 15 companies with interests across different industrial sectors.

The group, founded in 1963 through an Act of Parliament, is a self–financing, national development finance institution. Chemplex Corporation, which is 100 percent owned by IDCZ, requires about $60 million to improve capacity. Chemplex also holds a 50 percent shareholding in the Zimbabwe Fertiliser Company. The country's largest fertilizer and chemical manufacturing company's subsidiaries include Zimphos, Dorowa Minerals, the country's sole phosphate producer, Chemplex Marketing, Chemplex Animals & Public Health, GD Haulage and G&W Industrial Minerals.

- fingaz

Top Zimbabwe business executive arrested for fraud

Top Zimbabwe business executive arrested for fraud  South Africa is in serious trouble

South Africa is in serious trouble  US halts visa services for Zimbabwean nationals

US halts visa services for Zimbabwean nationals  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zimbabwe Agricultural Show 2025 kicks off

Zimbabwe Agricultural Show 2025 kicks off  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick