Meikles Limited (Meikles) has come out "guns blazing" against the Securities Exchange Commission of Zimbabwe (SEC) over transparency issues related to Mentor Limited (Mentor), with the group threatening to petition government over the unending saga.

This comes as the diversified group - with a market capitalisation of $31 898 723 - has slapped the market regulator and Zimbabwe Stock Exchange (ZSE) with a $50 million "delictual" damages claim over its suspended share last week.

"Meikles submits that the decision to publish questions runs the real risk being interpreted… as a publicity stunt… to publicly smear Meikles…," John Moxon said, adding the "public trial that SEC had set in motion can only have a detrimental effect on the integrity of the process itself".

"The issues raised… do not only affect Meikles, but all the entities listed on the stock exchange who expect impartiality, integrity and professionalism the institutions… to regulate their activities," the maverick businessman said, adding the manner in which "statutory regulators conducted themselves in the business sphere tended to directly affect Zimbabwe's ability to attract foreign investment".

"It is, therefore, imperative that these institutions… retain at all times the highest standards of integrity in… decisions that they are empowered to take in order to bolster investor confidence in the country."

Even, though, Meikles' share was suspended for seven days, its price has continued to trade at 14 cents on the ZSE.

It is not clear, though, what sort of relief Moxon is seeking from President Robert Mugabe's government over the manner in which its share was temporarily suspended by the ZSE in consultation with Tinashe Chinamo's SEC.

While the towering Meikles man emphasised that they would fully address the questions raised, the group was going to demonstrate that "the allegations made by the SEC are baseless".

"The public is assured that Meikles declines the invitation to respond to the questions raised by the SEC through the newspapers," Moxon cheekily said and in his trademark fashion of a man who is not shy to defend his turf.

About a week ago, a local weekly reported that the Meikles chair was facing a shareholder revolt over a number of issues bordering on corporate governance issues and particularly the $12 million owed by British Virgin Islands-domiciled Gondor Capital (Gondor), and another Moxon company Coolbay.

Under the arrangement, the former purportedly assumed the liability and just as it has been holding the funds for the century-old conglomerate's regional expansion.

The money, which formed part of the aggressive businessman's well-publicised feud with Nigel Chanakira, has once again emerged as a source of potential fights with other shareholders, who want it returned to Zimbabwe.

With BVI known as one of the world's most sought-after tax havens, Meikles' decision to cart away millions to the island nation or capital has caused some consternation in other quarters.

Gondor, which was registered in March 2011, was supposed to generate nearly a quarter of a billion that would be used to grow the Zimbabwean business but no such benefits have accrued to date.

In 2011, Moxon's group described the investment as "a decisive move by major shareholders to mobilise upwards of $200 million for investment in Zimbabwe and future growth of the company"

According to the company's website, Meikles' major shareholders include Gondor at 47 percent, Old Mutual Life Assurance Company Zimbabwe 6,9 perecnt, Clayway Investments 5,5 percent while others hold 40,6 percent.

- dailynews

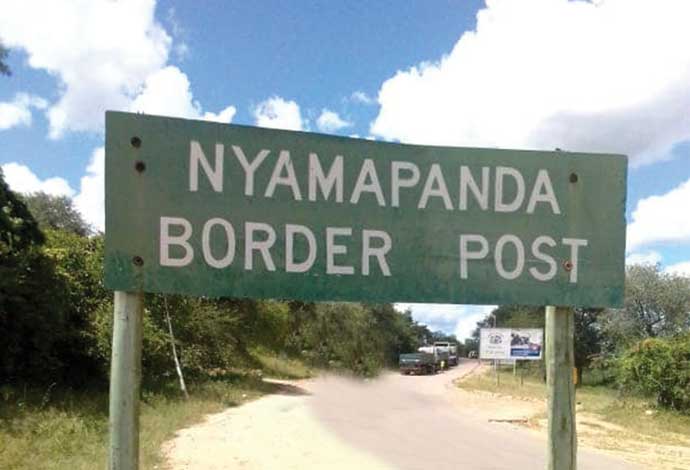

Nyamapanda immigration boss arrested

Nyamapanda immigration boss arrested  ZEP holders face renewed uncertainty

ZEP holders face renewed uncertainty  India dumps US Treasury bills

India dumps US Treasury bills  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  CBZ secures US$10m facility to fund SMEs

CBZ secures US$10m facility to fund SMEs  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick