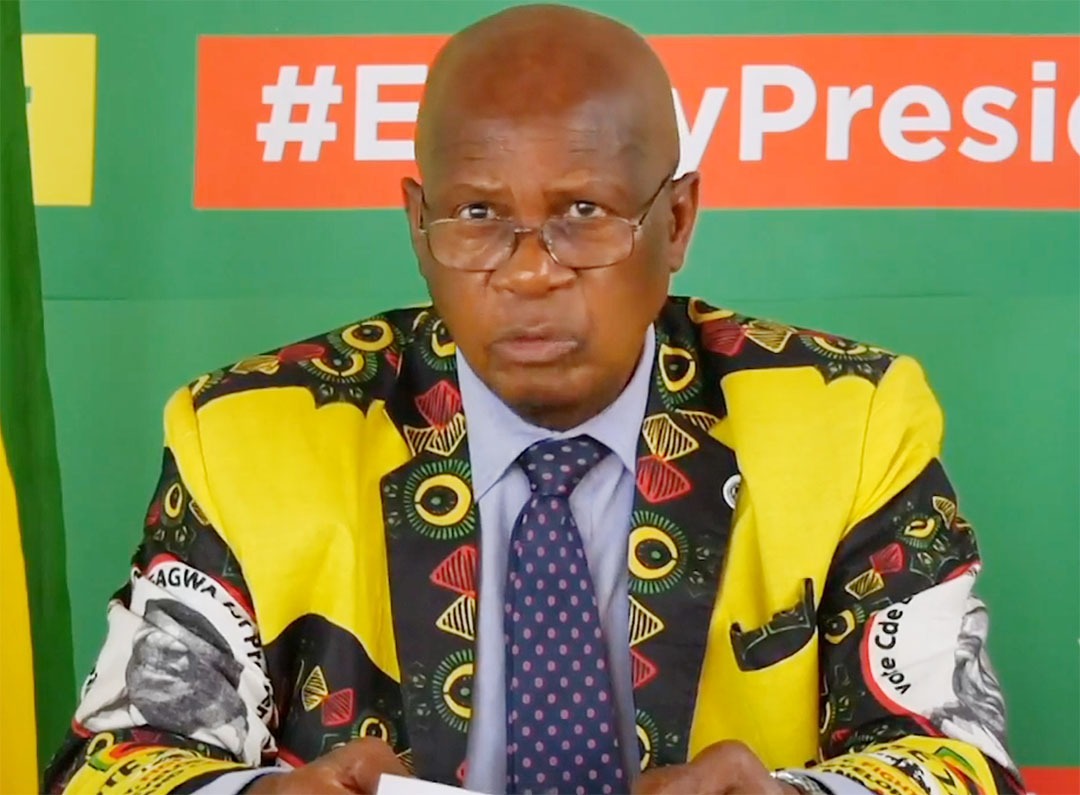

Econet Wireless Zimbabwe chief executive officer Douglas Mboweni, presenting the Group's financial results last week

ECONET Wireless Zimbabwe is desperate to find a quick solution to circumvent regulatory challenges which have hampered plans to list $50 million debentures on an external securities exchange to protect value for shareholders who bailed out the company during an emergency capital raise exercise last year.

The debenture obligations stem from a $128 million capital raise exercise, about half of which were debentures, which Econet undertook last year, as the company moved ahead of time to mobilise the foreign currency needed to settle external loans. These debts included the $300 million post dollarisation syndicated external loans Econet obtained to finance expansion.

Creditors that were meant to be paid from the proceeds of the rights issue and debenture instrument included Ericsson, Industrial Development Corporation (IDC) of South Africa, African Export-Import Bank and China Development Bank.

Between 2012 and 2014, Zimbabwe's biggest telecoms company, with over 11 million subscribers, obtained external loans amounting to about $460 million to finance network expansion and meet obligations from earlier debts, which were due.

Econet said while its board had wanted to list the debentures issued by the company on an external securities exchange shortly after the rights issue, the relevant authorities did not approve the request for a sinking fund, which it intended to use to repay the liability.

Econet had anticipated that things would proceed as planned, that it would get approval to set up a foreign currency sinking fund, into which repayments would be made, to ensure shareholders are repaid the same way they paid for the rights issue.

Econet undertook the capital raise cognisant of the fact that the foreign currency situation in Zimbabwe would make it difficult for it to secure the resources needed to meet its foreign currency denominated external obligations on time, given challenges local banks faced funding their nostros. If it did not raise the capital, Econet risked defaulting on its external loans.

"Shareholders of the company participated in rights offer by making payments to a designated offshore account, hence the desire to liquidate the debentures in a similar manner," chairman James Myers said in a statement accompanying the telecoms group's financial results for the year to February 2018.

Finance director Roy Chimanikire corroborated sentiments in the chairman's statement, during the presentation of the company's solid set of financial results, adding the rationale behind the sinking fund was value preservation through similar innovative ways Econet had used to build the group and create tangible value for all the shareholders.

"We want to continue to do that to create value for shareholders through various innovations that we look at. It is a problem around value preservation for the shareholder.

"We hope that the kind of innovations that we come up with will deliver more value and simply proceed on a certain course for timeliness sake, without really focusing on the value aspect of whatever we seek to do," Mr Chimanikire said.

He said the situation the company found itself in was not easy, but stressed the company would make sure that value preservation for shareholders was maintained and sustained even in the difficult circumstances the company found itself in.

Through the $128 million rights offer and debenture issue Econet Wireless raised a total of $67,26 million through the rights offer and $62,75 million through the debentures, which is essentially a debt instrument with fixed interest.

The Zimbabwe Stock Exchange listed mobile telecoms giant, which spent $132 million on capital programmes in financial 2018 from $32 million in 2018, says it has to date invested $1,3 billion towards building its expansive infrastructure.

- the herald

Zimbabwe sets deadline for company re-registration

Zimbabwe sets deadline for company re-registration  South African ambassador falls to death from Paris hotel room

South African ambassador falls to death from Paris hotel room  India dumps US Treasury bills

India dumps US Treasury bills  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Unifreight reports 231% revenue growth

Unifreight reports 231% revenue growth  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick