Blue Ribbon has concluded negotiations with Tanzanian grain miller Bakhresa Group in a deal that could result in the injection of $40 million in fresh capital.

Sources privy to developments said negotiations with Bakhresa have been concluded with only a couple of regulatory approvals the only outstanding issues to the deal. "The deal has been finalised and is waiting a couple of regulatory approvals from the authorities," the source said.

Since Blue Ribbon is not a listed entity, the outstanding approvals could be issues relating to indigenisation laws and the Competition and Tariff Commission.

In terms of the country's equity laws, foreign investors can only hold a maximum of 49 percent while locals should take the balance unless the responsible minister has given a special exception to a deal.

The source would, however, not discuss the intimate details to the deal saying it had reached a sensitive stage that could jeopardise efforts to revive the company.

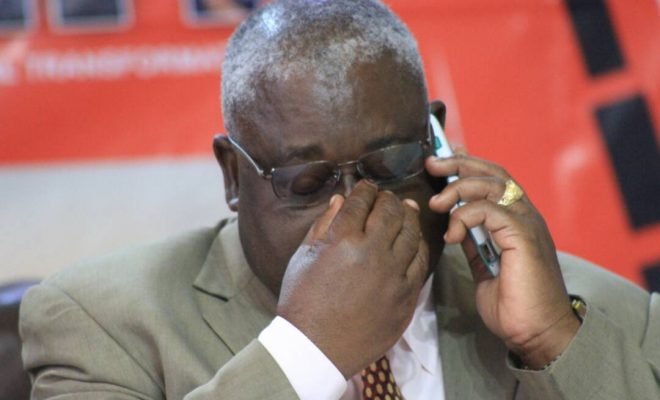

Grant Thornton Camelsa's Reggie Saruchera, who was appointed by the High Court as judicial manager of Blue Ribbon in 2012 could neither confirm nor deny that the deal has been finalised, only saying that "the deal is on track" and would be concluded soon.

This comes as the company is expected to resume operations in the next two months ahead of the injection of fresh capital by giant Tanzanian miller, Barkhresa.

"We decided to resume operations and bring back the popular brands this company produces while issues of fresh capital are being finalised," the source said.

Blue Ribbon, manufacturer of popular brands Ngwerewere and Chibataura, has reportedly agreed terms with a supplier, which enables it to resume operations.

According to Mr Saruchera the company requires $30 million to $40 million, with $15 million going to working capital and the balance to other obligations.

The company is buckling under heavy liabilities and shortage of funding to support operations, which saw the company putting workers on shifts to manage costs.

The Bakhresa Group will have to deal with the $30 million liability saddling the company apart from injecting fresh funding for recapitalisation and working capital.

Blue Ribbon was operating in fits and starts until the High Court placed it under judicial management two years back when output capacity fell to unsustainable levels.

It is not clear what stake Bakhresa would take, but sources said the stake would be determined by the amount of capital the group will invest in Blue Ribbon.

Blue Ribbon faces a crippling shortage of funding characterising local industry, which forced the company to borrow at punitive interest rates.

It has also been battling to repay a $2 million loan facility that was extended by PTA Bank.

Once one of the country's largest millers, Blue Ribbon has five main divisions namely BRI logistics, Blue Ribbon Foods, JA Mitchells and Nutresco Foods.

- The Herald

Zimbabwe police close in on US$4m robbers

Zimbabwe police close in on US$4m robbers  South Africa is in serious trouble

South Africa is in serious trouble  Israel bombs Qatar

Israel bombs Qatar  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zera warns against doorstep fuel delivery services

Zera warns against doorstep fuel delivery services  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick