NATIONAL electronic funds switch, ZimSwitch, recorded a 1 600 percent surge in digital transaction volumes during the first half of the year, from an average of 900 000 per month to over 16 million transactions monthly.

The surge was due to a shift by Zimbabweans electronic payment platforms due to a shortage of bank notes that has ravaged the economy.

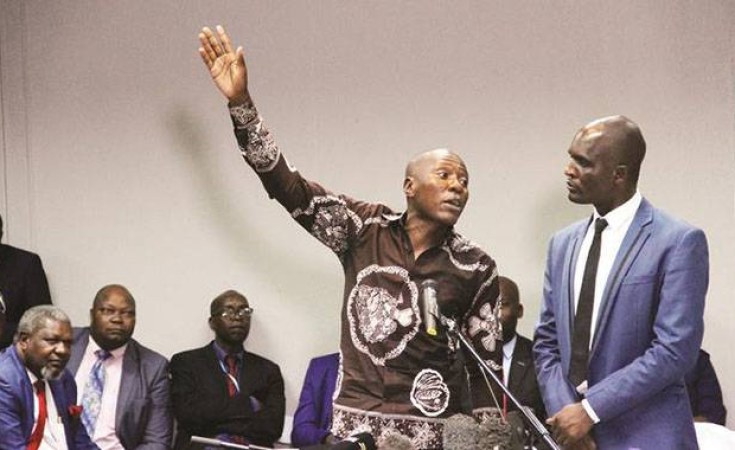

ZimSwitch chief executive officer, Cyril Nyatsanza, told The Financial Gazette that the surge - recorded on the firm's mobile money-transfer service, ZIPIT, and Point of Sale (Pos) outlets - had been driven by Zimbabwe's cash shortages.

"Around April last year, we were doing 900 000 transactions per month and we are now doing 16 million per month. But as you can see, our volumes have gone up so it has been a very steep trajectory for us as a service provider," Nyatsanza said.

The ZimSwitch boss said as a result of the surge in volumes, ZIPIT was struggling to process the overwhelming volumes, adding the firm had now invested in a system upgrade.

"Because of its real time aspect, industry and everyone else have started using it for business payments and we are saying it was not meant for business payments. Because of that, it lacks some details that a business or trade transaction would require and because of that we have had to upgrade to what we call ZIPIT 2," he said.

Nyatsanza said ZimSwitch had also expanded five fields on the upgraded platform.

"These include details like name, surname, ID number and other reference details needed in transactions, in terms of more personal details. This is handy for trade," he said.

Last month, Econet Wireless Zimbabwe's banking subsidiary, Steward Bank (Steward), acknowledged that it had experienced numerous transactional failures on the platform over the past few months due to high volumes.

Steward is among the biggest movers of both ZIPIT and ZimSwitch transactions in the banking sector.

Nyatsanza said ZimSwitch had completed the initial testing phases for ZIPIT 2, with the system expected to go live soon.

"We had our user accepted test finalised on the 24th of July. What remains is for banks to work hand-in-hand with their solution provider to upgrade their system so that the additional fields that we have put in will be able to be accepted by the various services.

"Once banks are done with their service providers – that is the IT companies supporting the service for them — we will then be live in industry with the additional fields. That exercise has now started," he said.

The ZimSwitch boss also highlighted that the electronic funds transfer group had approached the central bank for intervention to bring all of the country's 19 banks onto the ZIPIT platform.

"Now, just three banks are not available on ZIPIT, namely Standard Chartered, Barclays and BancABC. Because of that, we have gone to the Reserve Bank of Zimbabwe and the banking industry through the Electronic Payments Association to coerce and in a way mandate the rest of the banks to come onto ZIPIT," Nyatsanza said.

He pointed out that this would be convenient for Zimbabweans presently dealing with acute cash shortages.

"When innovation comes in, it is always a case of whoever wants can adopt it. So five years ago when ZIPIT started that was the case. However, we have now come to the realisation that for convenience, all banks must have the ability to receive ZIPIT. This is a process that is happening that is why we now only have three banks left; it is because of these interventions. It is work in progress; we never started this functionality forcing banks to take it on. So when this stance changes, the banks have to be brought on board as amicably as can be, for the sake of customers," he said.

The central bank is also working on a raft of measures to promote enhanced use of plastic and electronic money, which currently accounts for over 80 percent of retail transactions, to deal with cash shortages.

- fingaz

'Zimbabweans paying 15 different taxes'

'Zimbabweans paying 15 different taxes'  ZEP holders face renewed uncertainty

ZEP holders face renewed uncertainty  US reaffirms tough visa rules for Zimbabweans

US reaffirms tough visa rules for Zimbabweans  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Demand surges for Harare-Mutare flight

Demand surges for Harare-Mutare flight  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick