THE Zimbabwe Congress of Trade Unions (ZCTU)'s general secretary, Japhet Moyo, has revealed that at least $1,4 billion in the banking sector cannot be translated into physical cash because it was created through the Real Transfer Gross System (RTGS).

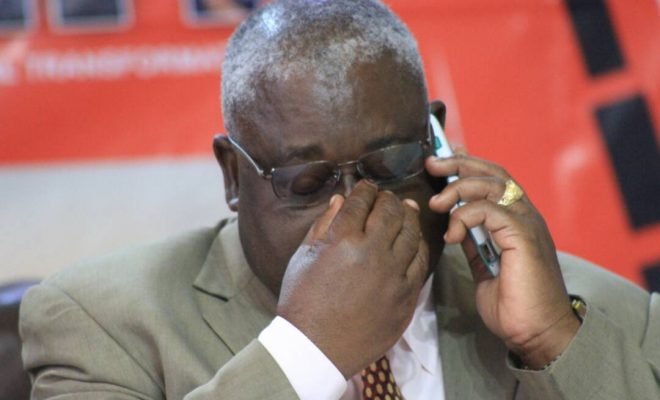

Moyo, who was part of a delegation of trade union leaders who met Reserve Bank of Zimbabwe (RBZ) governor John Mangudya to call for his resignation over an increasingly failing economy, said Mangudya had disclosed that there were no greenbacks to support the RTGS currency, which depositors have been failing to withdraw from banks.

Mangudya is said to have had a heated argument with the trade unionists, who had earlier written a letter calling on him to resign due to the bond notes crisis.

Bond notes were introduced in November to deal with a worsening cash crisis. They were said to be part of a package of export incentives under a $200 million African Export and Import Bank.

As a surrogate currency, they were pegged at the same value with the US dollar, but the bond notes have experienced significant value erosion on a parallel market, which has gained ground with intensifying foreign currency shortages on the official market.

"The governor underlined that he is not to blame for the failure of bond notes and instead told us point blank that we are targeting the wrong person in calling for his resignation. Instead, he said that government is to blame for the chaos due to lack of fiscal discipline among top officials. He noted that to date the $1,4 billion which is circulating in the RTGS is just air as it is not backed by any hard cash," he said.

Moyo disclosed that Mangudya had revealed government was in the habit of spending what it did not have. This had strained the monetary system.

"He revealed that the US$390 million which was recently channelled by government to the Grain Marketing Board is just air as it is not backed by any cash," he said.

Efforts to get a comment from Mangudya were fruitless as his mobile phone went unanswered.

Moyo added that the governor tried to impress upon the delegation that bond notes were working in the country's best interests but failed to submit concrete evidence to validate the claims.

The union wrote a letter on September 11, 2017 reminding Mangudya that he had promised to resign if bond notes failed to resolve the liquidity crunch. Before the introduction of bond notes, the ZCTU leadership met the governor and warned him that they would precipitate a crisis.

Recently, opposition parties and civic society groups have also called on Mangudya to honour his promise and step down.

"The sharp decline in the value of bond notes is giving rise to a parallel market, which has resulted in a hike in prices of basic commodities among other goods, a situation similar to the one we witnessed during the 2007-2008 era. Zimbabweans cannot be subjected to such a nightmare again. Hence, we demand the immediate resignation of the RBZ governor," they said.

- fingaz

Zimbabwe police close in on US$4m robbers

Zimbabwe police close in on US$4m robbers  South Africa is in serious trouble

South Africa is in serious trouble  Israel bombs Qatar

Israel bombs Qatar  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Zera warns against doorstep fuel delivery services

Zera warns against doorstep fuel delivery services  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick