For those seeking evidence that President Emerson Mnangagwa is set on a radical overhaul of the economy, Zimbabwe's monetary policy, expected soon, will definitely set the tone.

For all his bold talk of transforming the Zimbabwean economy, this monetary policy will provide mixed evidence. Undoubtedly, there has been much to cheer if the December 8 2017 fiscal policy is to be summoned in the debate. Assessing the full impact of this is tricky, because implementation takes time and an upturn in the economic cycle means unemployment should drift from its over 80%, in any case.

It has turned out to be a low-profile event since we dollarised. Not long back the announcement of a monetary policy was like an epic juncture for one to either go for broke or tame the daily challenges associated with eroding value of currency. The then governor would receive as much criticism as the accolades he will receipt for surprising the market at every opportune moment he was afforded the podium to outline the monetary objectives of the nation.

Blue collar workers, civilians, members of the security, the bureaucrats would all be holed up in one spot to digest the endless volumes of measures, some of them so fiscal in nature that the announcement of the budget was turning out to be a "curtain raiser" for the long-awaited monetary policy.

How daring the winds of change are. The soft-spoken but blunt John Mangudya, Reserve Bank of Zimbabwe (RBZ) governor, rarely minces his words when exposing any market misdemeanours he encounters in his daily work. He had grown to become so accustomed to criticism that his days at the biggest bank in the land were not freed from utopian scrutiny notably by competitors in the trade. His unassuming character will be put to test very soon as he announces the monetary policy .

It is a policy to be announced on the backdrop of a lethargic 2017 with most economic prospects dented by the declining commodity prices as well as the biting cash shortages which remain stubborn with each passing day. Such a baseline scenario of an average economic growth for 2018 averaging 4,5% is nonetheless predicated on a number of increasingly potent upside risks being expected, dominantly driven by agriculture and manufacturing.

However, predicating the 4,5% growth target on agriculture with a weight averaging only 14% to GDP computation might be a tricky path to rely on.

Risk aversion from foreign investors may lead to a reversal of sentiment towards the region and capital outflows, hence putting pressures on countries like Zimbabwe with large external financing needs, and forcing abrupt macroeconomic adjustments.

With a number of local banks desperate to attract tangible investors as the existing capital bases appear too thin given the toxic assets they are sitting on as well as the dominance of non-funded income which in all respects is unsustainable, it could be worthwhile to see them reviewing their status to either low-tier financial institutions or merge among themselves.

It is also pertinent to appreciate that merging two or more institutionally weaker banks will not bring about a stronger bank. This by implication means that it will be less costly to take the route of market exit rather than buying time through courting "dreamland" strategic partners. It is my fervent belief that we have some local banks which are never meant to exist in this multi-currency regime as their model of business cannot definitely withstand the ever-burgeoning informal economy whose unchallenged disposition to mobile banking is unmatched.

The recent major comeback of Time Bank remains a source of anxiety with a number of analysts wondering as to where the bank expects to pick deposits in this tough climate. We could be witnessing almost a similar trend with Nicholas Vingirai's Intermarket on the verge of making a comeback.

It is worrisome but at the same time interesting that the new political dispensation is bringing such an elevated level of confidence to the extent of attracting a bank to open its doors to the public in an environment characterised by depressed nostro accounts, and the threat of an interest rate cap not far off.

.

Some of the banks may find it untenable to continue existing and it is time they choose either to shape up or to ship out.

The near-absence of a robust corporate governance framework makes them an almost complete eyesore to would-be investors; the upcoming monetary policy has to correct any opaque shareholding structure in the existing banking institutions. It is even unfathomable to moot an efficient interbank market with a number of those struggling institutions on sight. In simpler terms, attempting to reintroduce the interbank market without entirely cleaning up the whole financial system can be impossible.

The monetary policy has to find means and ways to ease the cash challenges, raise the macroeconomic confidence, bring an independent voice to the ever-growing Real-Time Gross Settlement balance which has already breached the US$2-billion mark as well as incentivise the market players not only for export but also diversification.

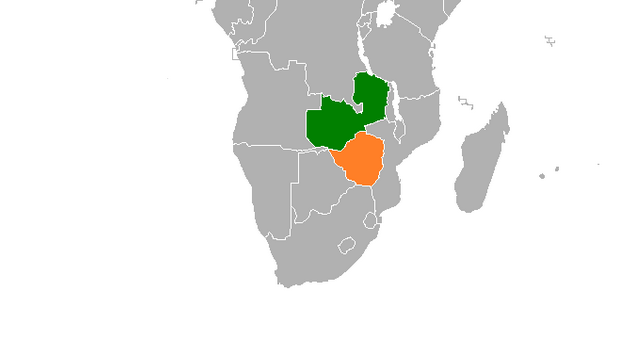

Like Zambia and Nigeria, which are over-dependent on copper and oil respectively, Zimbabwe has to find a way to escape that concentration risk. The stellar performance of artisanal miners in the gold sector could also be interpreted as an underperformance of the big mining houses, given that the former operate with antiquated tools and thrive much better in a grey economy as opposed to the conglomerates which have to face a litany of regulatory costs and forex shortages.

As much as Afreximbank has extended a facility to the government of Zimbabwe with the US$150 million expected to stabilise the nostro account, the effects have been negligible which is evidence that what this economy requires mostly is not unbalanced liquidity injection but rather it has to be a sustainable inflow backed by production and exports generation.

Without production and exports, the RTGS balances will remain pseudo Zim dollar balances which cannot and will never trade at par with the greenback regardless of whether a new volley of Operation Restore Legacy is effected to deal with the currency market.

This goes hand in glove with the capitalisation of the central bank with Treasury boss, Patrick Chinamasa, promising to further recapitalise the central bank to the tune of US$150 million. This, therefore, means the coming monetary policy must be a platform to interrogate and evaluate how the interbank market has fared since its re-operation whilst at the same time finding the best model of pricing financial instruments notably the Treasury Bills without leaving the paper unattractive as that tends to threaten the interbank market efficiency.

As a matter of fact, it is quite difficult to exit a dollarised economy and this is the hour the monetary authorities have to continue reminding the different economic participants in Zimbabwe that our greatest headache has nothing to do with currency, but rather the pace of activities in our factory.

A number of voices have been clamouring for the adoption of the rand but given the macroeconomic vulnerabilities of this economy coupled with the trade deficit Zimbabwe is currently experiencing against South Africa, the rand will still be too strong a currency for this economy..

There is also need to expedite the amendment of both the Banking Act and the RBZ Act with the call for accurate validation of true non-performing loans (NPLs) ratio a leading priority. Without complete knowledge through professional valuation of properties held by banks as security, the Zimbabwe Asset Management Corporation (Zamco) will turn into a white elephant which will be proverbially administering to HIV instead of confronting the fully blown Aids.

Mugaga is an economist and CE of Zimbabwe National Chamber of Commerce. These weekly New Perspectives articles are co-ordinated by Lovemore Kadenge, president of the Zimbabwe Economics Society, E-mail kadenge.zes@gmail.com, Cell +263 772 382 852.

- the independent

Zimbabwe announces sweeping reforms

Zimbabwe announces sweeping reforms  ZEP holders face renewed uncertainty

ZEP holders face renewed uncertainty  China-Russia LNG pipeline to deliver shock

China-Russia LNG pipeline to deliver shock  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Spur wants a bigger bite in Zimbabwe

Spur wants a bigger bite in Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick