In order to maintain a sustainable purchasing power equal to the rising cost of living reflected by a Consumer Price Index (CPI), a taxable salary or wage must increase faster than the increase in the CPI itself. This will result in after-tax wages which tally with the increased cost of goods and services.

Section 65 (1) of the Zimbabwe Constitution stipulates that: "Every person has the right to be paid a fair and reasonable wage".

Clearly, this is not what is happening on the ground, as most Zimbabwean workers are receiving unfair and static wages, ignoring the current price increases. If it continues unabated, this will soon lead to severe inflationary spirals.

Inflationary spirals are also called price-wage spirals, which represent a vicious circle in which wages increase because the price has increased, which, in turn, causes further wage increases, possibly with no answer as to which one came first. There are clearly two separate elements of the inflationary spirals that coexist and interact in an economy.

Firstly, holding economic sabotage constant, business owners have to raise prices to protect profit margins from rising costs and to keep the real value of profit margins from falling. This scenario is rife in Zimbabwe because of the absence of a nostro stabilisation facility held by the Reserve Bank of Zimbabwe to facilitate foreign exchange and trade transactions which has led to parallel market sourcing of foreign currency.

Secondly, wage-earners are now seeing the need to push their nominal after-tax wages upward to catch up with rising prices, and prevent real wages from falling.

The first element of the inflationary spiral does not apply if markets are relatively competitive. The obstructing case is that few markets in Zimbabwe are competitive, hence the likelihood of the first spiral occurring.

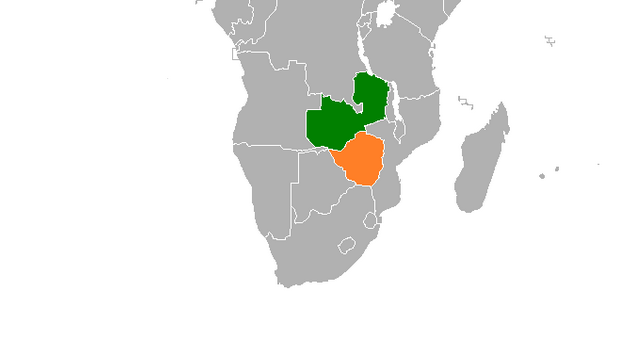

Would it be prudent to discard the bond currency and join the Rand Monetary Union or returning our Zimbabwean dollar as the multi-currency regime dominated by United States dollars is now a menace?

Butternut-headed economists would answer that it depends on the prevailing economic fundamentals. Personally, as a village economist, I will reserve the discussion for another separate enlightened discussion. The failure to provide solid answers to the currency question will mean that workers will suffer the most.

As from the last two quarters of 2017, how can a Zimbabwean employer justify a worker earning a pathetic static monthly salary given current price increases? Is it that businesses are not making profits in the current situation of price hikes?

This can be another version of money illusion - a wrong belief that wages have a fixed value in terms of its purchasing power. Deductively, it is a valid revelation that most workers in Zimbabwe currently do not earn a fair and reasonable wages.

In Zimbabwe, inflationary spirals will be ignited by price hikes of basic commodities, mainly fuel and food items. In turn, the overall basket of goods and services will eventually begin to be very expensive to everyone, justifying lobbies for higher wages through trade unions.

Accordingly, this has been testified from last week's young workers' call for government to introduce "Operation Restore Purchasing Power" by the Zimbabwe Congress of Trade Unions (ZCTU). The immediate and quick result to this are higher wages which will result in higher disposal income, which in turn drives the prices of goods and services even higher.

The inflationary spiral will emanate through strong unions such as the ZCTU. In fact, the liberation struggle effectively had its roots in the labour movement - with such stalwarts as the late Benjamin Burombo and Joshua Nkomo spearheading massive trade activism. However, one can reason that the ZCTU lost its lobbying grip between 1990 and 2017, as its membership was whittled down from 400 000 to 100 000 by economic collapse.

According to the Zimbabwe National Statistics Agency, inflation continues on the rise as inflation for the month of December stood at 3,46%, 0,49 percentage points higher than the November 2017 rate of 2,97%. Inflationary pressures mainly came from food inflation which stood at 6,60%, while the non-food inflation rate and non-alcoholic beverages inflation, which is prone to transitory shocks, was 2%.

We have also seen health inflation following the trends, rising from -0,68% in January 2017 to enter +0,02% in August 2017, and continued on an upward trajectory to close the 2017 year at 1,57%. The implications of rising healthcare inflation are to act as a barrier to healthcare seeking, which adversely affects health outcomes in Zimbabwe. Worse still, the health sector continues to be plagued by numerous challenges, including drug shortages, amid severe foreign currency scarcity.

In my view, if official inflation is to continue at the current rate, then Zimbabwe may soon hit above the 5% threshold as recommended by Sadc, triggering inflationary pressure in 2018. Rising inflation has adverse implications for the general population, with the poor being hit the most.

Consequently, if inflation has come against a backdrop of stagnant salaries, households are effectively poor. If left unabated, then the rising prices will cause social and economic unrest in the country, as citizens cannot continue to bear the untold suffering, which everyone expected to disappear with the coming in of the new political dispensation.

In fact, the skyrocketing of prices is one of the issues which the public expected government to address as part of its 100-Day Plan. Hence, going forward, government should address the issue of rising prices with urgency, before people call for a serious "Operation Restore Purchasing Power" supposedly through labour unions.

Government has the power to head off an inflationary spiral or to interrupt one by unholy ways such as price controls and preventing the rising of unions. On the other hand, if monetary policy instruments are to be effective, it can target monetary aggregates such as increasing interest rates.

However, as history has shown, in well to do economies it must be careful in doing so. In response to inflationary pressures caused by the oil price hike in the 1970s, then chief of the Federal Reserve chair, Paul Volcker, raised interest rates on numerous occasions, to interrupt the price-wage spiral. Unfortunately, the move helped to drive America into the recession from 1981 to 1982, one of the worst recessions in American history.

Ignorantly, some may argue that fears of an inflationary spiral in Zimbabwe are unfounded because of unions that are unable to negotiate large increases in wages or employees who fear having their jobs outsourced. Is that the case for Zimbabwean unions or its members being inactive to demand wage increase that match prices increase?

Certainly no.

Fortunately, with the new dispensation, unions can successfully manage to bargain for higher wages. However, this will obviously make the inflationary spiral difficult to get rid of, as people will quickly build increased levels of inflation into their expectations.

If price increases are unresolved "prices will chase wages and wages will chase prices." This price-wage spiral will interact with inflationary expectations to produce a long-running inflationary spiral.

Musvovi is a development economist at the Institute of Sustainability (Insaf). These weekly New Perspectives articles are coordinated by Lovemore Kadenge, president of the Zimbabwe Economics Society, email: kadenge.zes@gmail.com, cell +263 772 382 852.

- the independent

Zimbabwe announces sweeping reforms

Zimbabwe announces sweeping reforms  ZEP holders face renewed uncertainty

ZEP holders face renewed uncertainty  China-Russia LNG pipeline to deliver shock

China-Russia LNG pipeline to deliver shock  ZSE and VFEX recover after weak 1st half

ZSE and VFEX recover after weak 1st half  Gold edges up as traders await guidance

Gold edges up as traders await guidance  Spur wants a bigger bite in Zimbabwe

Spur wants a bigger bite in Zimbabwe  Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Young Investment Professional (YIP) Graduate Programme 2019

Editor's Pick